The Certified Management Accountant Certification qualifies you to work in high-level accounting and business leadership roles. If you have the ambition to be a CFO or function in the upper realms of financial leadership, CMA accounting is a great way to get there.

To become a CMA, you’ll have to pass the CMA exam and finish work requirements. All of this is achievable and this article will take you through all the steps you need to succeed.

I know because I’ve done it. I’ve been a CMA since I passed my CMA exams in 2012 on the first try. Now I share what I’ve learned with others (over 82,000!) — and it works. The pass rate of people who take my 16-week CMA Exam Accelerator course is 92% compared to the global pass rate of just 45%.

Read on to learn:

- What Is a CMA?

- The CMA Career Path

- CMA Designation Vs. Other Accounting Designations

- How to Become a Certified Management Accountant

- CMA Curriculum

- CMA Exam Prep

- CMA FAQ

Originally published in January, 2019, this article was updated and republished on December 2nd, 2025.

What Is a CMA?

A CMA, or Certified Management Accountant, is a globally recognized designation for accountants who work in corporate finance and management accounting.

Earning CMA credential means that you’re skilled in the areas companies rely on most, such as financial planning, analysis, control, and strategic business decision support, along with a strong grounding in professional ethics.

Issued by the Institute of Management Accountants (IMA), the CMA certification allows you to move into strategic, decision-making roles inside organizations, including FP&A, analyst, controller, and even CFO-track positions. To qualify, you’ll need a bachelor’s degree, two years of relevant work experience, and a passing score on the two-part CMA exam.

For more ways to define Certified Management Accounting, check out my in-depth article on what a CMA is.

Certified Management Accounting Job Description

In practical terms, CMAs work inside organizations to help companies make better financial decisions. Their day-to-day responsibilities often include budgeting and forecasting, analyzing financial performance and cash flow, evaluating investments, improving internal processes, managing costs, assessing risk, and presenting insights to executives.

Because they bridge accounting and strategy, CMAs are frequently hired into roles like financial analyst, cost accountant, controller, finance manager, accounting manager, FP&A, and CFO-track positions.

To earn your credentials as a CMA, candidates have to demonstrate competency in financial planning, business strategy, decision making, and various other fields. Once qualified, they can work in a variety of advanced and lucrative management accounting roles.

I found out about CMA accounting while looking for a credential that could help me move up the corporate ladder without having to go through the CPA route. It was really the CMA subject matter that appealed to me because I knew I’d be a strategic thinker rather than just a number cruncher.

One major difference between CPA and CMA certified accountants is that CMAs don’t just know the “what” behind the numbers. CMAs understand the “why” when it comes to accounting and finance.

Certified Management Accountants exhibit mastery in financial planning and analysis, control, decision support, and professional ethics. In the process of earning the CMA certification, they learn the skills to become successful strategic business partners and effective financial managers.

What Does a CMA Do?

If you are new to the CMA certification, you probably don’t know what makes us unique. CMAs have several key skills and roles that make them stand apart from other designations.

For starters, CMA accounting has a focus on understanding the critical skills needed to have a successful business. We are respected for our ability to perform in key management and executive roles. CMAs analyze financial performance, manage budgets, support strategic decisions, evaluate investments, control costs, and guide leadership on what the numbers mean for the future of the business.

More and more employers are seeking out Certified Management Accountants to join their executive team. Our practical skills give businesses greater credibility and higher potential for profits.

CMAs are highly valued and reap the benefits of this financially. On average, people with this designation earn 47% more than their non-credentialed counterparts, but more on that later.

Global CMA Recognition

Recognized globally, the CMA designation opens the path to multiple accounting careers, from Financial Analyst to Accounting Manager and Corporate Controller, all the way to Chief Financial Officer.

Once you pass the exams, your new skillset allows you to apply for higher-paying positions and gives you the leverage needed to negotiate a higher salary.

The CMA Accounting Career Path

Pursuing a CMA career path is a lofty goal. There are plenty of great opportunities in the market for people who can function as business and financial leaders. Certified Management Accountants can work in government agencies and publicly or privately held businesses, and hold prestigious corporate positions.

Certified Management Accountant Jobs

Some of the many CMA career opportunities include:

-

- Become a CFO (Chief Financial Officer)

- Treasurer

- Controller

- Finance Manager

- Budget Analyst

- And more!

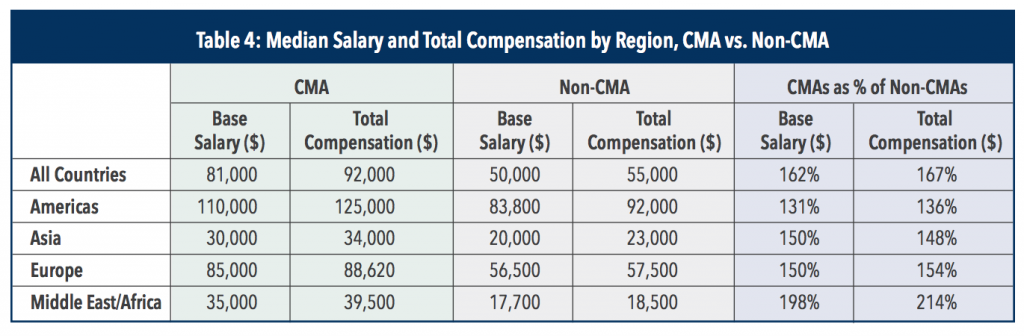

CMA Salary

It’s no secret that many people pursue accounting jobs because of the higher than average pay, and a CMA accounting designation will increase your earning power even more.

CMA salaries in the US are significantly higher than accountants without the designation. Here’s a breakdown of average base salaries globally for Certified Management Accountants and those without the designation:

CMA Designation Vs. Other Accounting Designations

While you have many accounting designations to choose from, the CMA has certain advantages over others.

Strategic Management Focus: CMAs lean into strategic management accounting. Instead of just reporting numbers, the credentials train you to understand what those numbers mean for the business and how they should guide the next move. CMAs are taught to think like decision-makers, which is why the designation works for people who want to influence strategy rather than just support it.

Global Relevance: One of the things I love about the CMA is its portability. As work becomes increasingly global and teams spread across borders, having a credential that’s recognized and respected internationally makes a real difference. Unlike some designations tied to a single jurisdiction, the CMA gives you room to work (and grow) almost anywhere.

Cost Management Expertise: The CMA designation focuses on cost management, one of the most practical, real-world skills you can bring to a business. CMAs are trained to understand where money is being spent, what’s actually driving costs, and how to allocate resources better. In industries where every dollar matters, this kind of insight is a huge value-add and often sets CMAs apart from other accounting designations.

Ethical Emphasis: And then there’s the ethics component. The CMA doesn’t treat ethics as a checkbox topic — it’s woven into how you think, how you lead, and how you make decisions. The CMA Code of Ethics is meant to guide professionals through real, nuanced situations, not just theoretical ones. It’s part of why CMAs tend to be trusted as both financial experts and responsible leaders.

There are additional differences that separate the CMA from other accounting designations. I go into more detail about those differences in the posts below:

For me, the CMA designation is the best. It opens doors to advanced roles in management accounting, leadership positions, higher salaries, global opportunities, and more.

How to Become a Certified Management Accountant

Becoming a CMA requires that you follow a few basic steps.

First, you’ll need to study for, take, and pass the CMA exam. Then, you’ll have to fulfill work requirements before you can achieve your CMA certificate.

Each year, to maintain your certificate, you’ll have to take ongoing education credits. Read on to learn more about the requirements to get your Certified Management Accountant designation, including education, experience, and the CMA exam.

CMA Requirements

To be a CMA, you’ll need to become a member of the Institute of Management Accountants and pass Parts One and Two of the CMA exam.

CMA Exam Requirements

To take the CMA exam, you’ll simply need to have an IMA membership and pay the CMA entrance fee. Once you are a member of the IMA, you can register for the CMA exam. Most people buy a CMA review course and study materials to support this process.

There are two parts of the CMA exam. You must score 360 or more on each section to pass.

CMA Certification Requirements

It’s important to know the full CMA certification requirements, as outlined below. Follow the links to get more info on each step:

-

-

- Become a member of the IMA.

- Buy a CMA exam review course.

- Pay the CMA entrance fee.

- Register for and take the CMA Exam.

- Complete a bachelor’s degree or accepted professional designation.

- Complete work experience requirement.

-

One of the CMA requirements is a bachelor’s degree from an accredited university, although it doesn’t have to be in finance or accounting. The IMA also accepts some professional designations in lieu of this requirement.

Finally, to obtain your CMA certificate, you’ll need to have two continuous years of work experience in financial management or management accounting. Candidates have up to seven years after passing the CMA exam to meet this requirement.

After you’ve passed the CMA exam and completed two years of work, you’ll use your IMA account to submit proof and apply for your CMA certificate.

You must know that your commitment doesn’t end there. There is a CMA CPE requirement to complete 30 hours of continuing education every year in order to maintain your certificate.

CMA Exam

The CMA exam is taken in two parts. The test is composed of multiple-choice questions and two essay questions. You’ll have three hours to finish the multiple-choice questions and one hour to finish the essays. It’s important to show all of your work and pay close attention to details as you progress through this challenging exam.

CMA Testing Windows

The CMA exam is offered in three testing windows. Each year, you can take the CMA exam in any of the testing windows, which are:

-

-

- Testing Window 1: January-February

- Testing Window 2: May-June

- Testing Window 3: September-October

-

For each testing window, you have until the 15th of the last month in that period to register for the CMA Exam.

Your CMA exam release date will be about six weeks after your test date.

CMA Exam Registration

To start the CMA exam process, you will join the IMA and pay the CMA entrance fee. Once that is complete, you will study for the CMA exam and be free to schedule it at any time.

Scheduling the CMA exam can happen online through IMA’s testing partner, Prometric. Through their online portal, you can find the nearest Prometric testing center and schedule your CMA exam.

CMA Exam Cost

All in, the CMA exam will cost over $1,700. This doesn’t include investing in a high-quality CMA course, which most students will (and should) do. Here’s the breakdown:

-

-

- IMA membership: $295 ($49 for students; $160 for academics)

- CMA entrance fee: $300 ($225 if you are a student)

- CMA exam Part 1: $545 ($407 if you are a student)

- CMA exam Part 2: $545 ($407 if you are a student)

- CMA annual maintenance fee: $30

- CMA exam study materials: $500-$1,500

-

Learn more about the CMA exam cost in our in-depth article.

Certified Management Accounting Curriculum

Finding the right CMA review course makes all of the difference if you want to pass on your first try. Because the CMA exam does cost some money, you need to make the right up-front investment in a study program that will help you pass.

If you pass the CMA the first time, any money you spend on a study program will be well worth it. If you don’t pass the first time, you aren’t alone. The CMA exam is difficult, and the pass rates are less than 50%.

That said, you can do it by following a quality CMA study guide, gathering all the study materials you need, and sticking with your study schedule.

Here’s some more info on what each part of the CMA exam covers, with links to more info.

CMA Part 1

Part One of the CMA exam covers the following:

-

-

- External financial reporting decisions, worth 15%

- Planning, budgeting and forecasting, worth 20%

- Performance management, worth 20%

- Cost management, worth 15%

- Internal controls, worth 15%

- Technology and analytics, worth 15%

-

CMA Part 2

Part Two of the CMA exam covers the following:

-

-

- Financial statement analysis, worth 20%

- Corporate finance, worth 20%

- Decision analysis, worth 25%

- Risk management, worth 10%

- Investment decisions, worth 10%

- Professional ethics, worth 15%

-

CMA Exam Prep

Preparing for the CMA exam is, for most people, a full-time job. Depending on how long you have to study, you’ll need to carefully manage your time. Most experts recommend at least 16 weeks of concentrated study per part.

If you can’t take time off work or have a lot of other obligations, you’ll need even longer. It’s vital that you approach the CMA exam with the right mindset and are ready to work hard.

How to Study for the CMA Exam

People who pass the CMA exam the first time do a few key things.

First, you need to choose a CMA study course that works for you. Preview the materials. Check out the instructor. Get any free downloads or previews you can. Make sure that you enjoy the structure and feel confident that it will work for you.

Second, follow a CMA study plan. Don’t wing it. Thoughtfully structure your time and lifestyle to work around your studies (not the other way around).

These are just two of my top CMA exam study secrets to get you started with the right mindset.

CMA Study Materials

Not all CMA study materials are created equal. There are a lot of options. When it comes to choosing the best CMA review course, you want to do your homework.

Some test prep companies offer a huge variety of study programs for professional courses, while others specialize in accounting tests, like the CPA or CMA. The latter may be preferable because you’ll be sure they focus on very specific aspects related to this field.

You also want to be sure that you get all of the available features. CMA study books, flashcards, practice tests, CMA question banks, and more will go a long way in giving you comprehensive exposure to the subjects and test structure.

Many people find that buying a CMA program that has tutoring or coaching makes the biggest difference in their exam prep. This feature can provide you with one-on-one attention and guidance. If you have real-time access to an expert CMA instructor, you can ask all of your questions and get insightful feedback about what you need to work on.

CMA Exam Academy is proud to be a complete resource for your exam prep. When it comes to CMA review courses, ours are the best. As many features as you want, optimal integration, and expert CMA coaching come standard with each of our packages.

Go here to shop CMA Courses online.

Certified Management Accountant FAQs

Here are some answers to frequently asked questions about Certified Management Accounting and the CMA certification.

Is Certified Management Accountant Worth It?

Becoming a certified management accountant is one of the clearest paths to the c-suite. In other words, if you have the ambition to be in an executive accounting position, a CMA designation can get you there. Many CMAs become CFOs and executive financial figures. CMAs are known for having both business and financial acumen, which opens a lot of doors. With a higher-than-average earning potential and plenty of prestige, a CMA is a great career choice.

Is CMA Harder Than CPA?

The CMA exam is different from the CPA exam. Both cover a broad quantity of accounting topics. You will want to do your due diligence as you decide which path is right for you. There are a few key differences between CMA vs. CPA, including exam requirements, salary, and potential careers. CMAs may earn, on average, a higher salary than CPAs, and CPAs are qualified for all types of public accounting. Much of this depends on your interest and having a clear picture of your career goals.

How Many Years Is a CMA Course?

Studying for the CMA exam should take about 16 weeks per part. This is a significant amount of time to dedicate to studies but it is well worth it. The CMA exam costs, on average, several hundred dollars to take. It’s important to spend the right amount of time preparing so that you have the best chance of passing the CMA the first time.

What Does a CMA Accountant Do?

CMAs can work across many roles in corporate finance and management accounting. Because they’re trained in both business strategy and financial analysis, they often step into leadership positions where they influence planning, budgeting, performance evaluation, and decision-making. Common CMA-held roles include CFO, Treasurer, Controller, Finance Manager, Budget Analyst, Senior Financial Analyst, and other positions that blend accounting expertise with big-picture strategy.

How Much Does a Certified Management Accountant Make?

Certified management accountants make a higher-than-average salary. According to IMA statistics, CMAs in the US earn a median total compensation of $135,000 a year (with a mean of $157,578), making it one of the highest-earning markets for certified management accountants.

Why Is Becoming a Certified Management Accountant so Important?

Certified Management Accountants occupy an important role in many businesses. While the scope and capacity can change, they provide visionary leadership that’s well informed by financial best practices. CMAs lead the way in strategic planning, insightful analysis, and financial leadership.

The numbers speak for themselves and there is no better time than now to become a CMA. CMA’s are in high demand and low supply and with my help, you absolutely have what it takes to succeed.

Don’t settle for an unfulfilling career.

Dream big and become a Certified Management Accountant.

You won’t regret it!

Hi, I’m Nathan Liao (aka the CMA Coach)! For the last 10 years, over 82,000 accounting and finance pros came knocking at my door seeking guidance and help. If you’re also aiming to conquer the CMA exam on your very first try—without wasting away time or money—you’ve found your ultimate guide. Dive in deeper to discover more about me and the dedicated team that powers CMA Exam Academy. Click here and let’s embark on this journey together!

34 Comments on “Certified Management Accountant Certification: Everything You Need To Know About the CMA Designation”

Hi Nathan – I see that in the beginning of this article, it says that it is estimated that your course will prepare us to pass the CMA exams in 16 weeks.

Later on, it says that experts say that each part of the exam will need 16 weeks of preparation.

Can you confirm whether the 16 week preparation is for both parts of the CMA exam or 16 weeks for each part?

Thanks

Hi Patrick,

Thank you for your question. Please note that our program is for 16 weeks per part.

For all the details I invite you to visit: https://cmaexamacademy.com/product/premium-cma-coaching-combo-part-1-part-2/

Hi Nathan, I’m a housewife without job experience . I’m interested but I would like to know whether I am eligible for this course and my degree is from India (Bachelor of commerce) .

Hi Aparna,

You don’t need to have work experience to start studying for the CMA.

You’ll have 7 years to gain relevant work experience and fulfill your CMA experience requirement after passing the CMA exams. The CMA certification will also help you get better jobs.

If you have any other questions, please don’t hesitate to hit reply.

Hi,

Regarding the professional requirements, can I show 2 years of qualified work experience prior to CMA ?

Hi Caio,

Yes, you can submit the educational requirement to IMA either prior to taking the exam or no later than 7 years after passing both parts of the CMA exam.

Nathan

Hello,

I want to ask about CMA requirements. I have no bachelor’s degree. I accountant and manager of my own small company since 2012. Does it wise to take CMA course, if after I will not get certification? Could you tell me what should I do?

Hi Arunas,

Thank you for your question.

The knowledge and skills you’ll gain from taking a CMA course is very valuable with certification or without it. Especially as a business owner, having this type of knowledge will help you run your business better. I speak from experience.

To learn more about our program here’s our page with all the information for your review: https://cmaexamacademy.com/product/premium-cma-coaching-combo-part-1-part-2/ref/nathan/

If you have any other questions, please don’t hesitate to reach out again.

I’m completely new to this field as I have background in Engineering. I plan to change career to management and I believe CMA will not only give me a solid knowledge but also a value added in my career.

Can a non accounting or financial candidate use this material? if not, please what is the best training material / test prep company that you can recommend?

Thanks

Hi Theo,

CMA candidates often come from varying backgrounds, but we’ve had students with no previous accounting background who successfully completed our program and passed the exam. I’m sure you will too!

For those who don’t have an accounting/finance background, learning the fundamentals of accounting is the first step before diving into the CMA exam content. Our program includes a textbook to help in this area.

If you have any other questions, please let me know.

Thanks,

Nathan

Hi, Nathan-

May I know how often do we need to renew the CMA certification? Is it annually?

Thank you.

Raquel

Hi Raquel,

Yes, once you earn your CMA certification, your IMA membership expires, it will need to be renewed annually.

Keep in mind that to retain your certification, you’ll also need to fulfill your annual CPE requirement.

You can read more about Continuing Professional Education Requirements in the article How To Fulfill Your CMA CPE Requirements (and Find Eligible Courses)

If you have any other questions, please let me know!

Nathan

Hello,

Regarding the professional requirements after the exam, what do you have to provide to show that you have fulfilled 2 years of professional work?

Hi Elba,

This is the experience verification form you’ll need to submit to the IMA to get your work experience approved.

Hi, I’m Anitta. I’m a degree student. Can you tell which is the best course that i can do after my degree, CA or CMA?

Hi Anitta,

It depends on what type of work you want to do. If you’re interested in auditing and taxation, then CA will be a good route to take.

If you’d like to get into management accounting, then I recommend the CMA.

Thanks,

Nathan

Pingback: Best CMA Exam Review Courses & Study Materials [2020]

Pingback: Certified Management Accountant Salary: A Guide for 2020

Pingback: Understanding the CMA Exam Passing Score

Pingback: CMA Careers: Your Guide to High-Paying CMA Roles

Pingback: Understanding (and Mastering) Your CMA Exam Questions

Pingback: CMA Part 2: Your Syllabus in a Nutshell | CMA Exam Academy

Pingback: CMA Part 1 Demystified: Your Definitive Guide

Pingback: How to Become a CMA: 10 Steps to Getting Certified

Pingback: CMA Certification Requirements: What It Takes to Get Started

Hi, if i have work experience in my county (in Uzbekistan) does it counts? My Bachelor’s also from Uzbekistan. But I have nasba’s evaluation and Globe Language Center evaluations

Hi, yes it absolutely counts!

i am from the Philippines and I want to take this CMA examination.. I am a CPA and currently employed in a government owned and controlled corporation as its Department Manager for Finance Operations..

Where will I start and what is the cost of investment for this course…

Hi Annaliza, to learn more about how the course works and the investment in it, please click here to see our review course. Thanks, Nathan

what the changing in exam at 2020 ?

Here’s an in-depth article on what’s changing in 2020: https://cmaexamacademy.com/cma-exam-changes-in-2020/

Pingback: The Institute of Management Accountants - CMA Exam Academy

Hi Nathan.

I read the article above. I’m a little confused about the salary comparison between CMA holders and non-cma’s. In one place you say that cma’s in America make a median salary of 125k but in the chart directly beneath it it says that the median total compensation for a CMA is only 33k. Can you explain which is the correct figure as 33k seems a little low but also 125k seems a little on the high side for a median salary.

Secondly I want to ask for clarification on the amount of work experience required. I’m pretty sure that cpa’s only need to gain 1 year of work experience but from your article it says that cma’s must gain 2 years. I just thought that both accounting bodies would expect a similar length of work experience to qualify. So it is definitely 2 years that’s required of a CMA in order to gain the credential?

Kind regards,

Michael White

Hi Michael,

Sorry about the compensation data. The correct chart is now showing accurate information.

As for work experience, the CMA requires 2 years of qualified work experience, not 1 year.