So, you’ve passed the CMA exam. Congratulations! Now it’s time to sit back, relax, and enjoy your new skills and certification, right?

Not quite.

Holding a CMA is a big deal. It demonstrates your commitment to excellence in leadership and accounting. That commitment is shown in your dedication to studying for the exam and earning all the requirements. However, once you obtain your certification, maintaining your commitment is essential.

That’s why all CMAs are required to complete Continuing Professional Education (CPE) hours each year they hold their certification.

While it can seem like a chore, CPE is actually a great opportunity to further your professional development. The key is to find learning opportunities that are engaging and relevant to your career so you can continue to climb the ladder.

Let’s discuss some of the CPE requirements for CMAs and what accessible, fun, and affordable options you have to earn your hours.

In this article:

- What Are the CMA CPE Requirements?

- Acceptable Subjects for CPE

- How to Get CPE Certified

- How to Calculate Your CPE Hours

- CPE Masterclasses From Industry Professionals

- FAQs

Originally published on November 8th, 2022, this article was updated on August 21st, 2024.

Want to watch this? Check out the video format on my YouTube channel.

What Are the CMA CPE Requirements?

Each CMA is required to complete a minimum of 30 hours of CPE credits each year.

Here are some of the details:

- CMAs must begin obtaining CPE credits one calendar year after earning their certification.

- Each year, the 30 required hours must be logged between January 1 and December 31.

- Only approved subjects are acceptable.

- At least two hours each year must be dedicated to ethics courses.

- CMAs can earn up to 40 hours in a year in order to carry over up to 10 hours to the following year.

What Happens if a CMA Doesn’t Meet the Annual CPE Requirement?

CPE requirements are necessary to remain in good standing with the IMA. A failure to meet these standards will result in your IMA account being deactivated. This means your CMA status is effectively revoked and considered delinquent until you resolve the dispute.

CMAs who haven’t met the CPE requirements can resolve a dispute with the IMA by making up the hours the following year. This means that they will need to earn 60 hours of CPE credits by the end of the second year.

How Can a CMA Submit CPE Hours to the IMA?

It’s recommended that CMAs organize their CPE hour information in the transcripts section of their IMA member profile.

The IMA performs random audits on CMAs to ensure they are complying with the requirements. If selected, you’ll be required to submit proof of completion for each hour you’ve claimed. For this reason, it’s important to keep track of every credit you complete.

Some documents pertaining to CPE that you should keep a record of include:

- Proof of registration or enrolment

- Attendance records

- Progress reports

- Certificates of completion

- Performance records

How Long Should a CMA Keep Records of CPE Credits?

It’s recommended that CMAs keep a physical or electronic record of their completed CPE credits/certificates for a minimum of three to five years. This way, they are able to prove their completion and validity in case of an audit.

Why Is CPE Important for Continued Professional Development?

There’s a reason the CMA holds weight in the professional world. It’s because those who earn one are dedicated to their professional development. In order to uphold that standard of distinction, it’s necessary to continually prove that dedication by improving one’s skills and competencies.

Taking CPE Courses Throughout the Year

The annual CPE requirements are meant to encourage and motivate professionals to upskill and stay on the top of their game.

Of course, it’s tempting to cram all the courses into a short period at the end of the year to meet these requirements. While this will help you reach your target credits, it defeats the purpose of taking these CPE courses. Rushing through them without taking the time to learn and understand their content will have much less of an impact on your skills and career.

Try to spread your CPE courses throughout the year to give yourself enough time to digest and understand the materials well. As you grow your skillset and knowledge, you’re bound to achieve your desired job advancements and salary bumps!

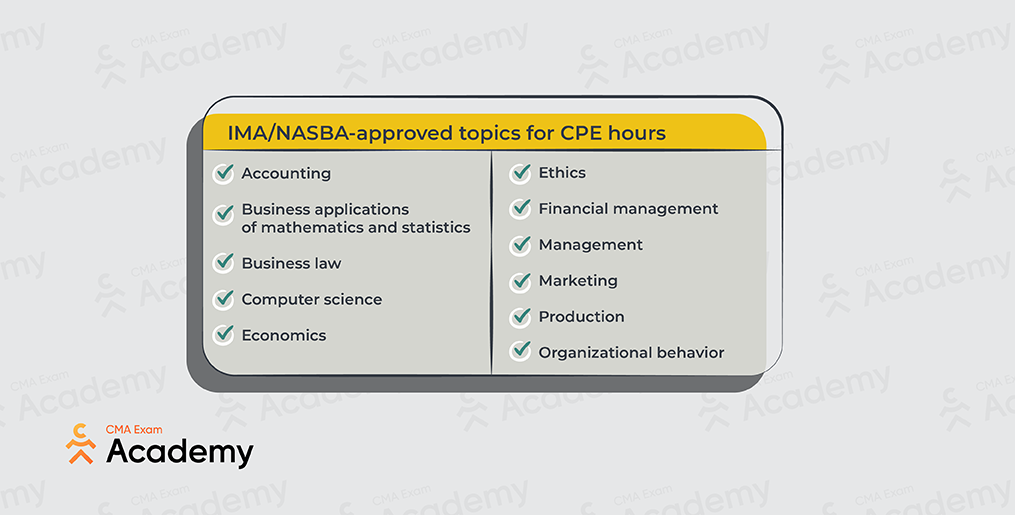

Acceptable Subjects for CPE

When completing the required hours, it’s important to ensure the courses you select are in approved subjects.

Here are some of the IMA/NASBA-approved topics for CPE hours:

- Accounting

- Business applications of mathematics and statistics

- Business law

- Computer science

- Economics

- Ethics

- Financial management

- Management

- Marketing

- Production

- Organizational behavior

Visit the IMA website to learn more about approved subjects and to confirm if a course meets the requirements.

Ethics Requirements for CMAs

All CMAs are required to complete at least two hours in ethics CPE credits every calendar year. If a professional exceeds this number, they may carry forward up to two hours to the following year.

How to Get CPE Certified

Ideally, professionals will develop a plan that allows them to record and manage their hours. Cramming all 30 hours into the last month of the year will result in a stressful and risky experience.

There are many ways to earn CPE hours. From college courses to webinars, professionals have a lot of options to choose from.

So long as the program or course is offered through a formal instructor and involves NASBA-approved instructional and training material, it will likely qualify.

Informal instruction, such as standard job training, does not qualify.

Let’s go over some of the best ways to earn CPE hours.

Taking a College Course

College or university courses that are at least 10 weeks long can qualify for CPE credits. These courses can be taught online or in person by an accounting professor, college accounting department, or subject expert.

For college courses, here’s how credits are calculated:

- One semester is the equivalent of 15 credits

- One quarter semester is the equivalent of 10 credits

- Each 50-minute class in a non-credit course is one credit

Taking a Short Course or Seminar

Short courses and seminars are modules that last 10 weeks or less. The benefit of this option is that they are easy to complete and can involve networking with other CMAs.

Professional CMA seminars can be a lot of fun and can cover a wide range of topics taught by experts.

For seminars, here’s how credits are calculated:

- Each 50-minute seminar or class is the equivalent of one credit

- A day-long seminar with 6.5 hours or more of course time is the equivalent of eight credits

Taking a Professional Examination

Professional designation exams can be claimed as CPE credits only if the CMA hasn’t also claimed the hours spent on a prep course or self-study program for the same exam.

CMAs can claim up to 10 hours, with each hour completed counting as one credit.

Taking a Self-Study Course

Juggling work, family commitments, and time for yourself can be challenging. If you’re a busy professional, the most convenient way to fulfill the annual requirements is to take a self-study course. You can do these courses from the comfort of your own home; all you’ll need is a device like a smartphone or laptop.

The CPE Flow hub offers a range of online masterclasses to help you earn your credits while you learn from leading accounting and finance experts. You’ll be able to grow and upskill in a wide range of industries. The best thing is that these courses are self-paced, allowing you to tackle them anytime from anywhere!

Serving as a College or University Instructor

Being an instructor requires constant adaptivity, problem-solving, and leadership. For that reason, lecturer hours can qualify as CPE credits.

Here are the details:

- College course credits are calculated by multiplying the course credit hours by the number of weeks for which the course runs.

- Instructors can claim credits for the same course only once every three years unless the course material changes significantly.

Serving as a Speaker or Discussion leader

Leading a seminar course or workshop can also qualify for CPE hours in the following circumstances.

- The course must be professional, business-oriented, associated with a professional development center, or associated with a college or university.

- Credits are calculated by multiplying the number of presentation hours by two.

- Credits can only be obtained the first time the seminar is given.

- In the case that the seminar changes significantly, additional credits may be given for the presentation hours once per year.

Submitting and Publishing Technical Materials

Creating, submitting, and publishing relevant content can qualify for CPE hours. The types of content that the IMA accepts as creditable include:

- Technical articles

- Monographs

- Books

Work submitted but not accepted for publication qualifies for half the credit it would have earned had it been published. The same article cannot earn further credits if it is published in the future.

An accounting and financial management article can earn a maximum of six credits. Books or monographs can earn a maximum of 20 credits. The exact amount of credit earned is determined by the IMA.

How to Calculate Your CPE Hours

CMAs are responsible for ensuring they meet the standards for CPE hours. This means they must calculate and document all credits they earn.

Most approved courses and programs will clearly state how many hours each unit or class qualifies for.

To calculate how many hours you have completed, begin by assessing how many previously earned hours you have to carry over. Each year, CMAs have the opportunity to carry over a maximum of 10 hours earned over the mandatory hours from the previous year.

If you earned 32 hours last year, you may carry over two hours. If you earned 40, you may carry over 10. If you earned 60, you may carry over 10.

Once you’ve determined how many hours you have to complete, it’s a good idea to divide the rest of the hours by 12 to see how many credits you need to earn per month. Then, you can create a reasonable plan that maximizes your ability to absorb information.

CPE Masterclasses From Industry Professionals

Self-directed CPE courses have always been my preferred avenue for getting credits for a number of reasons. First, I love having the freedom to work from anywhere. I also love being able to select topics that directly relate to my career and interests.

Although I loved self-study methods, I often found it difficult to organize my own credits to ensure I was getting courses that were approved and relevant. And so many of the courses that were relevant were, honestly, a bit boring.

That’s why I created CPE Flow, an ongoing series of exclusive CPE masterclasses taught by industry-leading Certified Management Accountants.

Imagine Netflix meets university; that’s CPE Flow. I like to think it’s the perfect blend of entertainment and education. You’ll get unique, current, and engaging masterclasses that will make earning CPE hours fun.

Check it out for yourself, and you’ll see what I mean.

FAQs

Still have questions about earning your CPE hours? Here are some common concerns I hear from CMAs.

What Is the Renewal Period for CMAs?

CMAs are required to renew their CPE by December 31, the end of each calendar year. From the start of the reporting cycle, they have a full year to complete the requirements.

What Is the CPE Reporting Cycle for CMAs?

The CPE reporting cycle begins at the start of each calendar year on January 1. They have a full year to complete the requirements before the renewal period ends.

Are There Any Minimum CPE Requirements in a Particular Subject?

Yes. All CMAs must include a minimum of two hours of CPE credits in ethics courses each year. Currently, this is the only CPE requirement for a specific subject.

How Many CPE Credits Can Be Completed Through Self-Study Courses?

Provided the course is compliant with NASBA requirements, CMAs can complete 100% of their CPE credits through self-study courses.

Can CMAs Carry Over Excess Credits Earned the Previous Calendar Year?

CMAs can carry forward a maximum of 10 hours from the previous calendar year. This includes a maximum of two hours in ethics.

What Happens When a CMA Doesn’t Complete the Required CPE Hours?

CMAs are required to complete CPE hours to retain their status as Certified Management Accountant Professionals. In the case they fail to complete the requirements, the IMA will set their account status to delinquent.

Professionals under the delinquent status will have one calendar year to complete 60 CPE hours, else their account will be deactivated, and their CMA certification will be invalid.

CMA Continuing Education Courses

Fulfilling your annual CPE requirements doesn’t have to be a drag! Learning is meant to be fun and exciting, and that’s exactly what the CPE Flow courses bring to the table.

You’ll increase your skillset and knowledge base by learning from experienced instructors whenever and wherever you want. These courses fit into a busy lifestyle and are produced by award-winning creatives, offering both entertainment and convenience as you upskill!

Hi, I’m Nathan Liao (aka the CMA Coach)! For the last 10 years, over 82,000 accounting and finance pros came knocking at my door seeking guidance and help. If you’re also aiming to conquer the CMA exam on your very first try—without wasting away time or money—you’ve found your ultimate guide. Dive in deeper to discover more about me and the dedicated team that powers CMA Exam Academy. Click here and let’s embark on this journey together!