I have been a CMA for over a decade now and one of the most common questions I get asked is, “What’s better – CMA vs CPA?”

Unsurprising, there is a lot of confusion about the difference between the two financial and accounting designations; more and more as the CMA rises in popularity.

In general terms, an accountant with a CMA will likely work as a management accountant in private or public companies. An accountant with a CPA license will typically work in tax, compliance, and auditing in public companies.

In this article, we’ll explore the differences between a CPA and a CMA, and show how this will affect your decision to choose a designation that’s right for you.

Let’s break it down.

This post was originally published on June 25th, 2020 and last updated on May 8th, 2023.

In this article:

- What’s the difference between CMA vs CPA?

- What is a CMA (Certified Management Accountant)?

- What is a CPA (Certified Public Accountant)?

- CMA vs CPA Exam

- CMA and CPA Syllabus Overlaps

- CMA vs. CPA Exam Difficulty

- The Cost to Take the CMA Exam vs the CPA Exam

- CMA vs CPA Requirements

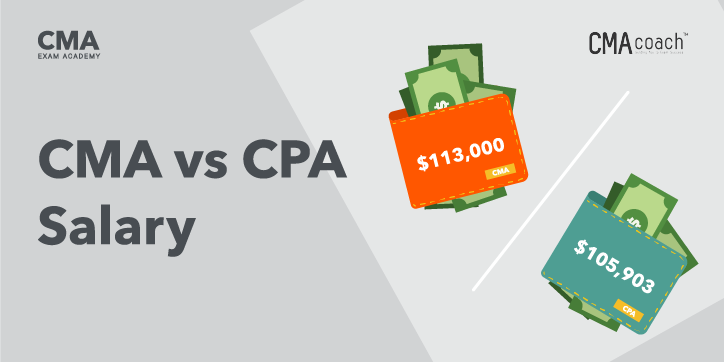

- CMA vs CPA Salary

- CMA vs CPA Careers

- Which Designation is Right for You?

What’s the difference between CMA vs CPA?

CMA vs CPA: what’s the difference? A CMA (certified management accountant) focuses on identifying business growth strategies based on their comprehensive financial analyses. This stands in contrast to a CPA (certified public accountant), a more general accounting designation that isn’t as involved in management and strategy decisions.

CMA CPA Offered by Institute of Management Accountants (IMA) American Institute of Certified Public Accountants (AICPA) Exam 2-part exam 4-part exam Exam fees Around $1,000 Around $1,500 Average exam pass rate 45% 54% Employment opportunities Cost Accountant Consultant Chief Financial Officer Corporate Controller Management accountant Public Accountant Internal/External Auditor Tax Accountant IRS Agent Consultant

What is a CMA (Certified Management Accountant)?

The CMA designation is offered by the Institute of Management Accountants (IMA), who is responsible for testing and administering the CMA designation. The certification is earned by someone who has obtained a unique financial accounting and strategic management skill-set.

The IMA works with the ICMA – Institute of Certified Management Accountants – to process exam registrations, but in terms of exam development, the ICMA is responsible for any changes to the CMA certification requirements.

Some of the most common CMA tasks include analyzing and deciphering data to initiate financial improvement in businesses. Unlike CPAs, they do not simply crunch numbers to review, but they actually identify the strategy behind business decisions based on their financial analysis.

Some of the most common career paths for those with a CMA designation include Cost Accountant, Corporate Controller, Risk Manager, Staff and Sr. accountant, Chief Financial Officer (CFO), Accounting Manager, and VP of Finance.

What is a CPA (Certified Public Accountant)?

Certified Public Accountants (CPA) are individuals who are licensed to practice public accounting duties. This can be anyone from a tax or accounting consultant to a business advisor or auditor.

Just like CMAs, to earn their designation they must pass rigorous testing and fulfill several prerequisites.

As far as differences go, it’s pretty clear that the biggest difference between CMA vs CPA is the particular skills they possess. CMAs are more strategic and forward-thinking partners in business, while CPAs are mostly focused on taxation, auditing, and the day-to-day accounting activities.

Some common career paths for CPAs include public accounting, tax accounting, internal auditing, forensic accounting or financial planner.

CMA vs CPA Exam

If you’re interested in exploring how to get your CMA certification, you’ll need a CMA exam passing score. And to do that, you’ll need to study and prepare in advance, as the test is far from easy. (Although with the right tools, knowledge, and CMA exam study materials, — which you can get by taking a Certified Management Accountant course prior to taking the test — you can learn ahead of time how to pass the CMA exam on your first attempt.)

To become a CMA or CPA you first must complete several exams in addition to meeting several other prerequisites (which we will get to shortly). There are numerous CMA multiple choice questions covering various topics.

These exams are quite challenging: the CMA pass rate is only 45% for Part 1, and 45% for Part 2.

There are some rather large differences between the CPA and CMA exams and this may very well impact your decision to move forward with one designation over the other.

First and foremost, the CMA exam is made up of two parts:

- Part One: Financial Planning, Performance and Analytics

- Part Two: Strategic Financial Management

CMA Exam: Part One

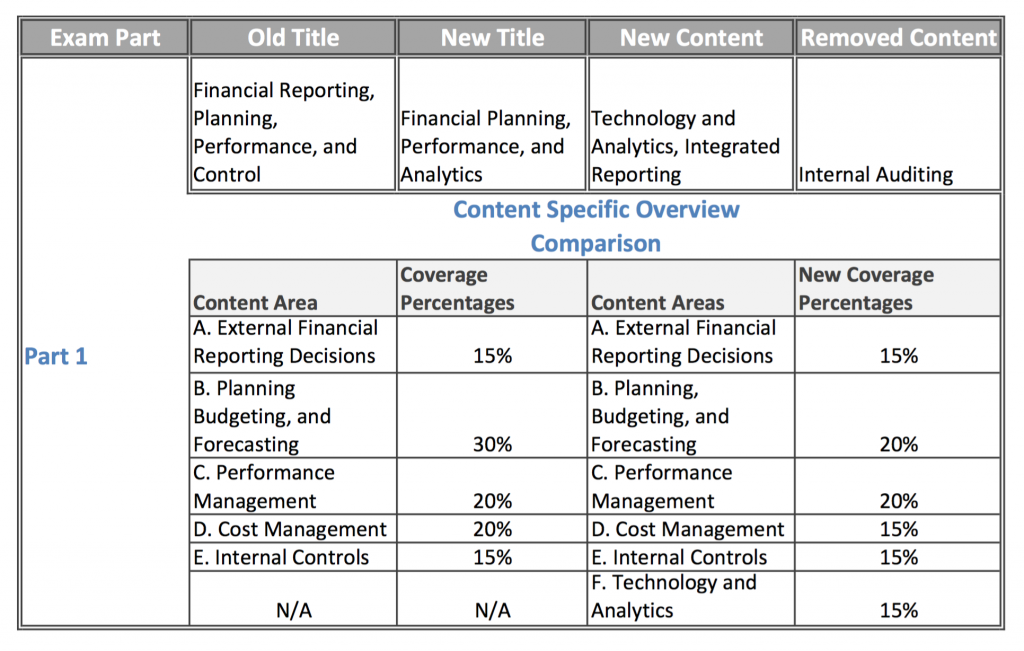

There are a number of upcoming CMA exam changes in 2020, which are based on the evolution of CMAs in the real world.

Part One will now consist of 6 competencies including:

- Cost Management – 15%

- Internal Controls – 15%

- Technology and Analytics – 15%

- External Financial Reporting Decisions – 15%

- Planning, Budgeting, and Forecasting – 20%

- Performance Management – 20%

It is fairly clear that based on these changes the ICMA ( the institute responsible for developing the exam) are playing a greater importance on analytic skills like data reporting and critical decision making.

What is most noticeable about this change is the removal of Internal Auditing. This isn’t to say that Internal Auditing is not useful, rather that the IMA wants CMAs to focus more on the management of controls rather than the auditing side of things.

Here’s how the changes in 2020 compare to the current CMA exam format:

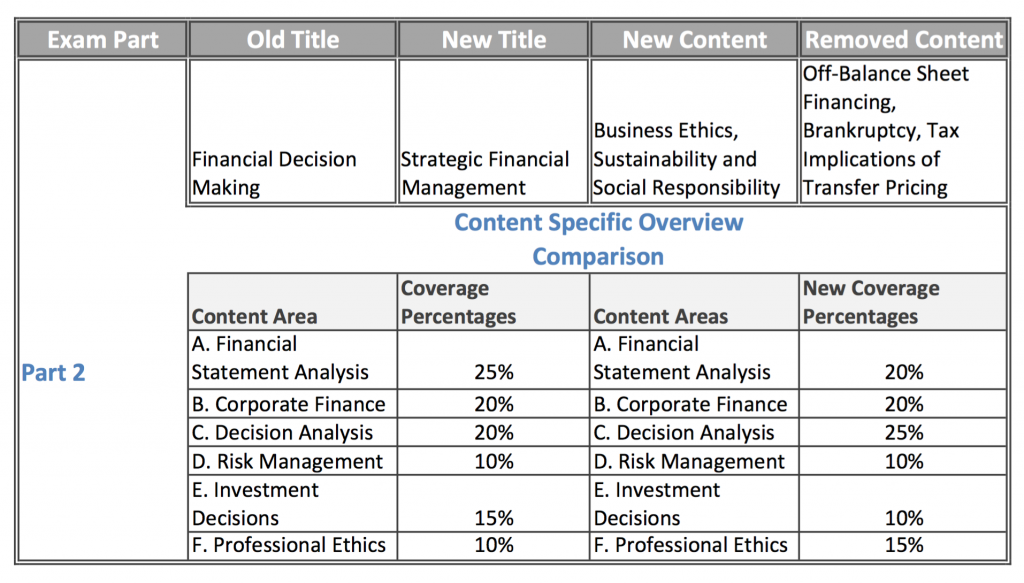

CMA Exam: Part Two

There were quite a few changes that took place for Part 2 of the CMA Exam as they prepare for the 2020. Like its counterpart, Part Two will cover the following 6 competencies:

- Risk Management – 10%

- Investment Decisions – 10%

- Professional Ethics – 15%

- Financial Statement Analysis – 20%

- Corporate Finance – 20%

- Decision Analysis – 25%

Here’s how the changes in 2020 compare to the current CMA exam format:

CPA Exam

The biggest difference between CPA and CMA exams is that the CPA exam is a four-part exam. Although the CPA exam is undergoing major changes in 2024, the four-part structure is expected to remain unchanged.

That being said, the structure of those four parts is changing.

Previously, the CPA exam was made up of four learning foundations:

- BEC: Business Environment & Concepts

- FAR: Financial Accounting & Reporting

- AUD: Audit & Attestation

- REG: Regulation

Now, the licensure model is shifting to what is known as a Core-Plus-Discipline model.

So, the first three parts will remain similar:

- FAR: Financial Accounting & Reporting

- AUD: Audit & Attestation

- REG: Regulation

These are considered core competencies that all certified accounting professionals should possess. The changes will come in the fourth section, previously called BEC: Business Environment & Concepts.

This section will now be broken down into three subcategories:

- BAR: Business Analysis and Reporting

- ISC: Information Systems and Controls

- TCP: Tax Compliance and Planning

Each candidate will be required to select one of the above subcategories to specialize in.

In addition to these changes, the updated version of the exam will contain an increased focus on the role of technology in accounting throughout all four sections of the exam.

Changes to the Business Environment and Concepts (BEC) Section

The new BEC section will now be referred to as the discipline section. It is where you’ll be able to select a competency you want to focus on in your career.

Here’s an overview of what each discipline will examine:

BAR: Business Analysis and Reporting

The BAR discipline is four hours long. It is made up of 50 multiple-choice questions and 7 task-based questions. Each section counts for 50% of your overall grade.

If you are primarily interested in a career that involves financial analysis, reporting, technical accounting, advising, assurance, or operational leadership, then business analysis and reporting will be extremely useful for you.

Here are some topics you will cover:

- Risk management and mitigation

- Data analytics

- Financial planning and projecting

- Technical accounting

- Analytics reporting tools

- Revenue recognition

- Leases

- Hedge accounting

ISC: Information Systems and Controls

This section takes four hours and includes 82 multiple choice questions and 6 task-based questions. It is the only section of the exam that weighs the multiple-choice and task-based questions differently: the former is worth 60% of your overall grade while the latter is worth 40%.

If your interests are in tech and business, then information systems and controls may be a good option for you.

Some of the topics included in this discipline are:

- IT and data regulation

- Internal control troubleshooting

- IT auditing

- Network, endpoint, and information security

- Software access

TCP: Tax Compliance and Planning

This discipline takes four hours and comprises 68 multiple-choice questions and 7 task-based questions. Each half is worth 50% of your overall grade.

Candidates who are curious about tax compliance for both individual and organizational enterprises should pursue the tax compliance and planning discipline.

Here’s what you’ll learn:

- Financial planning for both individuals and enterprises

- Multijurisdictional tax compliance

- Property transactions, business formation, and liquidation

- Gross income inclusions and exclusions

Financial Accounting and Reporting (FAR)

The FAR section is a four-hour-long section with 50 multiple choice questions and 7 task-based questions. Each section’s score is worth 50% of the overall grade.

Some of the topics covered include:

- Standard-Setting, Conceptual Framework, and Financial Reporting

- Financial Statement Accounts

- Transactions

- Local and State Governments

Auditing (AUD)

The auditing section is four hours long and includes 78 multiple-choice questions and 7 task-based questions. Each section is worth half your overall grade.

As you likely guessed from the title, AUD covers auditing and assurance services. It tests your knowledge of the following competencies:

- Professional Responsibilities, Ethics, and General Principles

- Assessing Risk and Developing a Planned Response

- Performing Further Procedures and Obtaining Evidence

- Forming Conclusions and Reporting

Regulation (REG)

The regulation section of the exam is four hours long and is made up of 72 multiple-choice questions and 8 task-based questions.

REG is the only exam section that does not cover accounting topics explicitly. Instead, it covers the following:

- Professional Responsibilities, Ethics, and Federal Tax Procedures

- Business Law

- Property Transaction Federal Taxation

- Individual Federal Taxation

- Entity Federal Taxation

CMA and CPA Syllabus Overlaps

The CMA and CPA cover similar topics, as both are tracks meant to set you up for a career as an accounting professional. It can be helpful to understand what’s on each test, and see where topics overlap:

CMA Exam | CPA Exam |

PART 1 - Financial Planning, Performance and Analytics | SECTION 1 - Financial Accounting and Reporting |

External financial reporting decisions | Conceptual framework, standard-setting, and financial reporting |

Planning, budgeting, and forecasting | Select financial statement accounts |

Performance management | Select transactions |

Cost management | State and local governments |

Internal controls | |

Technology and analytics | |

PART 2 - Strategic Financial Management | SECTION 2 - Auditing and Attestation |

Financial statement analysis | Ethics, professional responsibilities, and general principles |

Corporate finance | Assessing risk and developing a planned response |

Decision analysis | Performing further procedures and obtaining evidence |

Risk management | Forming conclusions and reporting |

Investment decisions | |

Professional ethics | |

SECTION 3 - Regulation | |

Ethics, professional responsibilities, and federal tax procedures | |

Business law | |

Federal taxation of property transactions, individuals, and entities | |

SECTION 4 - Discipline (select one) | |

Business analysis and reporting | |

Information systems and controls | |

Tax compliance and planning |

As you can see, both the CMA and CPA deal with basic financial and accounting concepts, as well as financial management, ethics, corporate finance, and other practical areas.

The CMA deals more in higher-level concepts and business applications, while the CPA deals more with laws, governance, and technical components of accounting.

CMA vs. CPA Exam Difficulty

Most people will estimate the difficulty of an exam based on its pass rate. After all, the number of people who try and pass (or don’t) tells you just how challenging the exam was.

The CMA pass rate is currently 45%, and the CPA pass rate sits just over 54%. This is cumulative, although for the CMA this year, the pass rate was the same for both parts.

Based on these numbers, more people who take the CPA exam pass it, compared to CMA test takers. This may mean that the CMA exam is more difficult.

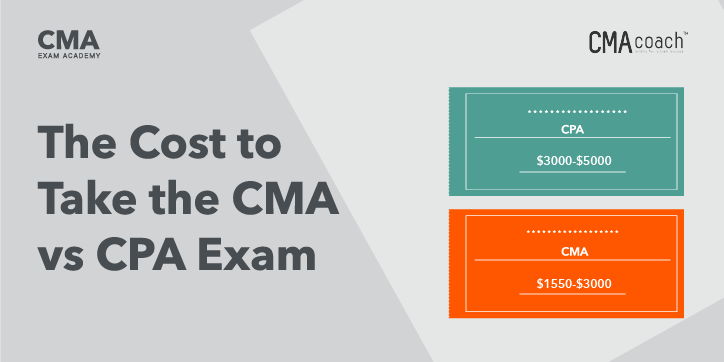

The Cost to Take the CMA Exam vs the CPA Exam

There are several variables that will affect the cost of earning your accounting designation of choice.

To give you a better idea, here is a generic breakdown.

CMA Exam Cost

Just like the CPA exam, the CMA exam has a registration fee. This is a $280 one-time fee that allows you to register for the exam, which takes place during designated CMA testing windows each year.

Each part of the exam costs $460.

The exam fee and registration may vary depending on your status as a student or academic. In this case, the registration fee is as low as $210, while each exam part costs only $345.

Purchasing an IMA membership is also a must and this can range anywhere from $45 annually, to $275 annually.

Similar to the CPA, most candidates choose to invest in a CMA review course; such as CMA Exam Academy.

Depending on the style and quality of review courses, prices can range from $699 per course to nearly $2000.

Again, there are also post-secondary school fees and continuing education fees that will bulk up the overall cost as well.

When added up, the overall CMA exam cost (again, not including your post-secondary education) can be in the ballpark of $1550 to well over $3000.

CPA Exam Cost

The average cost of a CPA review course is anywhere between $1000 and $3000 USD. Once you have studied and are ready to take the exam you will have to pay a one-time fee that allows you to register for the exam. Depending on your state, this can vary from $50 to $200.

Each exam part costs $193.45. To complete all four, it will cost you $773.80.

On top of your exam fees, you are also charged registration fees. Again, this varies by state, but more often than not you will be charged per section or can pay a lump sum and save by registering for all 4 sections at once. This can cost you anywhere from $177 to $252 for all four sections.

Other costs include your bachelor’s degree, licensing, Continued Education course fees, and for many, additional CPA exam prep fees.

All in all, the cost of becoming a CPA (not including your degree) can be anywhere from $3000 to $5000.

Check out Universal CPA Review if you’re looking for a solid CPA program.

CMA vs CPA Requirements

In order to become either a CMA or CPA there are several requirements you must fulfill.

In terms of education, to become a CMA you must have a 4-year bachelor’s degree in any field from an accredited university or college, or have a related professional certificate.

In addition to your education, you must obtain two continuous years of work experience in management accounting or financial management.

Even after you obtain your Certified Management Accounting certification, you will be required to complete 30 hours of Continuing Education every year.

To become a CPA you must earn a 4-year bachelor’s degree in accounting and have at least 150 credit hours of additional coursework. While some requirements vary from state to state, all states require that CPAs pass the CPA exam and maintain 40 hours of Continuing Education per year.

CMA vs CPA Salary

Perhaps one of the most common questions about the two designations is, what is the difference between a CMA salary versus a CPA salary?

A typical CMA salary in the US is $124,000, while a typical CPA salary is $79,316.

While CMA and CPA salaries tend to look pretty similar, CMAs generally make a little bit more. Having both designations will give you the best chance at a higher salary, but the difference is minor.

And if I’m being honest this is a pretty fair consideration since you want to make sure that earning your certification is going to be worth your time; both mentally and financially.

According to the most recent CMA Salary Survey conducted by the IMA, respondents holding a CMA certification made as much as 58% more than non-certified peers.

Respondents holding only a CPA earn only 30% higher median total compensation than their non-certified peers.

On average, those holding their CMA certification earn $122,000 while non-certified professionals earn $93,900.

CMA vs CPA Careers

CPAs and CMAs can work within the same teams, but their roles often differ. This is because the CMA prepares accounting professionals to take on leadership roles at their companies.

Some common career paths for CMAs include:

- Cost accountant: CMAs have the skills to solve complex financial problems as cost accountants.

- Consultant: Using their skills in strategic planning, CMAs can help businesses with statement analysis and financial projections.

- Chief Financial Officer (CFO): the dream career, CFOs are respected leaders in their field.

- Corporate Controller: CMAs in this position are strategic leaders who can help guide a company toward its goals.

- Management Accountant: the CMA prepares professionals to take on leadership roles in their organizations, which helps them earn more and build their skill set.

Alternatively, common career paths for CPAs include:

- Public accountant: a CPA equips you to provide sound financial advice to individuals and enterprises.

- Auditor or IRS agent: those who hold a CPA are qualified to perform audits on behalf of businesses or governmental agencies.

- Tax accountant: CPAs are eligible to support businesses and individuals with tax services.

- Consultant: CPAs can assist businesses with financial projections and statement analysis.

You can also look at a broader comparison of accounting roles in our Managerial Accounting vs Financial Accounting article.

FAQs

Here are some answers to frequently asked questions about the CMA versus CPA.

Is a CMA Better Than a CPA?

The CMA is an increasingly prestigious certification that can earn you a seat at the table where big business decisions are made. With a CPA, you can also play a crucial role in the operations of financial institutions and businesses of all kinds. One is not better than the other unless you have a specific career goal.

Some people choose to pursue both the CPA and CMA to broaden their opportunities as much as possible.

(Quick note: the CMA is also frequently compared to the CIA – Certified Internal Auditor. Check our CMA vs CIA article to learn how these two designations stack up against each other.)

Who Earns More: CMA or CPA?

Many regional and employment considerations impact how much you can make as a CMA versus how much you can make as a CPA. Here is a breakdown of salaries for CMAs and CPAs who have just started their first job with the certification:

- People with a CMA earn an average entry-level salary of $80,000 a year

- People with a CPA earn an average entry-level salary of $79,925 a year

- People with both a CMA and CPA earn an average entry-level salary of $97,250 a year

- People with neither a CMA nor a CPA earn an average entry-level salary of $65,500

Is CMA Worth it After a CPA?

With a CPA, you’ll already have plenty of employment opportunities. However, people with both a CMA and CPA have much higher earning potential and more prestigious career options. You’ll have to pass the CMA exam and meet the necessary work requirements, even if you’re already working as a CPA. Both credentials must be maintained through continuing education.

Is it Worth Getting a CMA?

The CMA is a great way to distinguish yourself in the world of accounting and finance. If you wish to go beyond the tactical components of accounting and become a business leader, becoming a CMA is a great way to do it.

Which Designation is Right for You?

Deciding on a designation is ultimately a personal choice. Consider your personal interests. Do you like number crunching, auditing and taxation or the more strategic and analytical aspects of managerial accounting? If the latter, opt for the CMA designation.

Do you want to earn a competitive salary and have a globally recognized designation?

How much do you want to invest in your finance and accounting career; both mentally and financially?

Answering all of these questions can help lead you to the designation right for you.

I am forever thankful that I added the CMA designation to my resume because it has allowed me to earn more money, get respect from my peers and opened so many doors for my career.

If you are leaning toward becoming a CMA then be sure to check out our 16-week Accelerator program.

I can help you pass the CMA exam on your first attempt and guide you toward a new and exciting career path.

Hi, I’m Nathan Liao (aka the CMA Coach)! For the last 10 years, over 82,000 accounting and finance pros came knocking at my door seeking guidance and help. If you’re also aiming to conquer the CMA exam on your very first try—without wasting away time or money—you’ve found your ultimate guide. Dive in deeper to discover more about me and the dedicated team that powers CMA Exam Academy. Click here and let’s embark on this journey together!

29 Comments on “CMA vs CPA: Which Accounting Designation is Right for You Based on 2024 Changes?”

I have completed my three year’s bachelors degree and two year’s master in commerce without experience. Would I able to apply CMA course?

Hi Priti,

you can absolutely join a course and take the CMA exam first, and then focus on gaining the required work experience afterward. Once you’ve completed the experience requirement, you can apply for your certification. You’ll have up to 7 years from the date you pass the CMA exam to fulfill this requirement.

For more details about our program I invite you to visit: https://cmaexamacademy.com/product/premium-cma-coaching-combo-part-1-part-2/

Hi nathan I’m doing MA Applied Finance after that which certification is suit for me CMA or CPA or CIMA or ACCA.

Hi Jude,

CPAs are in taxation, audit and compliance. CMAs are in managerial accounting. It comes down to the type of work you want to do.

To learn more about the CMA designation I invite you to visit: https://cmaexamacademy.com/how-to-become-a-cma-in-just-over-6-months/ref/nathan/

Can you let me know when this article was published.

Hi Fatima,

We published this article in December 2021.

If you have any other questions, please don’t hesitate to ask.

Nathan

Hello, if ever I plan to get both CMA and CPA, which title should I get first? Thank you.

Hi Vee, if you want to work in taxation and/or audit first, go for the CPA. If you want to work in management accounting first, go for the CMA.

Hi Nathan,

Is it possible to take Part 1 & 2 of the CMA both together? Can I attend classes for part 1 & 2 both?

Hi RD,

You surely can, however, this is not recommended. And that’s because candidates who focus on one part at a time tend to have a higher pass rate.

But I’ve had students who passed both parts within the same exam window, so it’s not an impossible goal for sure. As long as you have the determination and can dedicate sufficient time to your exam prep, the odds are on your side.

Let me know if you have any other questions. Happy to help.

Thanks,

Nathan

could a CMA certify Financial Statement as the CPAs do ?

No. CMAs don’t certify financial statements or tax returns. Only CPAs are licensed to do that.

Hello,

First I want to say thank you for the advice. I do not have a degree in accounting or accounting experience. I have a masters degree in Human Resource. What would be the best route to be prepared for the CMA?

Hi Se!

You’re very welcome!

To help you prepare more efficiently for your exam, I would recommend my coaching course.

It’s designed for candidates at all accounting levels. I’ve had students with no prior accounting background who successfully completed this program and passed the CMA exam on their first attempt 🙂

You’ll also get a “Pass or Full Refund” guarantee with this course. More on that here.

Let me know if you have any other questions or doubts, and I’ll gladly clear them up for you.

Thank you,

Nathan

Hi Nathan,

I am Chartered Accountant from India and my question is if this professional course is considered as bachelor degree for CMA eligibility?

Regards

Mirza

Hi Mirza,

Yes, the Chartered Accountant certification is on the approved list of certifications for the IMA’s education requirement, which means that you meet the education qualifications for the CMA.

If you have any other questions, please let me know.

Thanks,

Nathan

PLS MAKE MBA VS CMA IN DETAIL

Hi Majid,

I have an article on CMA vs MBA on my CMA Coach blog. You can read it there 🙂

Thanks,

Nathan

hie

with an acca degree would I be able to qualify for entry

Hi Tinotenda,

Yes, you would! The IMA waives the bachelor’s degree requirement for all ACCA members who want to earn the CMA credential.

To become a CMA you’ll only need to pass both parts for the CMA exam and fulfill the 2-year work experience requirement either prior to or within 7 years of passing the exam.

Thanks,

Nathan

Hai,

I have a three-year bachelors degree in accounting and a two-year diploma with no work experience in accounting. would i be able to apply for CMA?

Hi Tom,

Yes, you can take the CMA exam now and fulfill the experience requirements within 7 years after passing the exam.

For more info, please read this blog post.

Let me know if you have any other questions.

Thanks,

Nathan

HI Nathan,

I am engineering graduate and thinking of pursuing CMA. Do you think I can qualify for CMA requirements on education.

Regards,

Vishnu

Hi Vishnu,

Of course, if you have a bachelor’s degree, you qualify for the education requirement.

Thank you,

Nathan

Hi Alex,

Please help me in syllabus content comparison with CPA Regulation exam & CMA (both parts exam),

will it save time if I prepare for CMA & CPA exams.?

Kindly comment.

Thanks

Amit.

I’m already a CPA. But I want to expand my skillset as an accounting and finance professional. The CPA was compliance focused, but I’m interested in a more strategic role. Would it make sense for someone like me to also pursue the CMA?

Hi Alex,

Absolutely! As a CMA, you’ll have the knowledge and skills to take on a more strategic role and make financial decisions for a business or corporation.

Hi Mr Nathan,

Thank you for enlightening us over comparison of CMA vs CPA. Also would like to know how exemptions are set for either professionals to gain the other?

Thank You,

Best Regards,

Dileep

Hi Dileep,

It’s my pleasure! That’s a great question by the way. There are currently no exemptions between the CPA license and the CMA certificate. If you have any other questions, post them here 🙂 Thanks, Nathan