If you are considering a career in management accounting, then we need to chat.

Why?

Because the CMA certification is not the only option available.

That’s right, there is another management accounting certification available: the CGMA. So let’s compare CGMA vs CMA.

Many people weigh the relative benefits of CPA versus CMA when deciding which certification would benefit their career the most. CGMA offers a third option. It’s related to a CMA accounting certification but distinct from it.

The Chartered Global Management Accountant certification is a direct competitor of the CMA. This designation was created in early 2012 and is the brainchild of both the American Institute of Certified Public Accountants (AICPA) and the Chartered Institute of Management Accountants (CIMA).

What makes the CGMA certification different from the CMA and more importantly, which certification is better for you?

Watch this video or keep reading because I’m going to break CGMA vs CMA down for you.

In this article:

- What Is the CGMA?

- What is the CMA?

- CGMA vs. CMA Exam Cost

- CGMA vs CMA Syllabus

- Where Are the CGMA and the CMA Recognized?

- CGMA vs. CMA: a Brief History

- Eligibility and Requirements

- CGMA vs CMA: A Full Comparison

- Do Employers Want CMAs or CGMAs?

- CMA Salary vs CGMA Salary

- Is the CGMA or the CMA Worth It?

Originally published on July 19th, 2020, this article was republished on January 31st, 2023.

What Is the CGMA?

While you may already know what CMA is, let’s discuss the alternative. CGMA stands for “Chartered Global Management Accountant.” Like the CMA, it’s a certification that accountants can obtain to take on a new specialty and open up new career paths.

To become a CGMA designation holder you need to complete the CGMA Finance Leadership Program, as well as pass the exam.

In case you are unaware, the CGMA certification was first instituted in 2012 to promote management accounting in global contexts. You’ll need to meet certain CGMA experience requirements in order to qualify for this designation, just as you need to meet the CMA requirements to become a Certified Management Accountant.

How Much Does the CGMA Cost?

The CGMA exam cost is included in your CGMA subscription plan. Plans start at $495 and include two credits for taking your exams. Keep in mind that additional fees may apply if you need to retake the exam. You’ll also need to meet the CGMA experience requirements in order to sign up. You can register on the CGMA website.

There are four annual testing windows, each of which lasts five days. When you register, you’re only allowed to sign up for the next available window, and you cannot reschedule once the registration window has closed.

Once you become a CGMA certificate holder you are required to pay an annual membership fee of $495. If you earned your designation through the AICPA route, you must also pay annual AICPA dues which vary depending on the type of membership you have.

What is the CMA?

CMA stands for Certified Management Accountant. It is a professional designation offered by the IMA. Those who earn CMAs hone a specialized financial accounting, management, and strategic planning skillset.

CMAs often hold high-paying leadership positions such as CFO, Corporate Controller, Senior Accountant, Accounting Manager, VP of Finance, and Risk Manager. Their responsibilities often include financial data analysis and strategic leadership.

The CMA is a low-barrier-to-entry way to improve your career opportunities and your income. It has a significantly high ROI when compared to an MBA, for example. If you want to learn more about the CMA, check out this article on the subject.

CGMA vs. CMA Exam Cost

In short, the CMA exam fees are a bit higher than the CGMA exam fees, but that’s only if you neglect to include the cost of obtaining the requirements. To be a CGMA, there are multiple pathways (more on this in the eligibility requirements section of this article), but the most common route involves becoming a CPA first.

Taking the CMA exam will cost $740 for professionals and $555 for students. And remember; there are scholarships available for students that will help cover those costs.

The CGMA exam fees are included in the annual CGMA Finance Leadership Program membership fee of $495. The membership fee doesn’t cover the cost of an exam retake, but it does cover study materials.

CMA | CGMA | |

Exam fees | Between $740 - $555 | $495 |

CGMA vs CMA Syllabus

The CMGA and CMA are both designed to help you prepare for a financial management position so, as a result, the exam content is similar. Here’s a breakdown.

CMA | CGMA | |

First material covered | Exam Part One — Financial Planning, Performance, and Analytics:

| Operational Level:

|

Second material covered | Part Two — Strategic Financial Management:

| Management Level:

|

Additional material covered | N/A | Strategic Level:

|

Where Are the CGMA and the CMA Recognized?

The good news is that both the CGMA and the CMA are globally recognized certifications that can improve your career prospects and salary in a variety of industries.

Professionals in over 100 countries have benefited from the CMA certification and both the CMA and CGMA are helpful tools for employees all over the world.

CGMA vs. CMA: a Brief History

Both the CMA and CGMA are relatively new designations in the world of accounting. While the CPA has been around since the late 1800s, the CMA was established in 1972. Its goal was to provide individuals with more in-depth knowledge and understanding of financial planning and analysis.

CMA-certified professionals are greatly valued in large multinational corporations but can work in private or public sectors of any size. Their expertise can open doors to so many amazing opportunities!

Even newer than the CMA is the CGMA. Established in January 2012, this designation’s main goal was to build upon the global reach of management accounting.

Because the CGMA was birthed from both AICPA and CIMA, you can earn this designation through either entity, but eligibility and prerequisites vary.

Eligibility and Requirements

As I mentioned above, the eligibility and requirements for earning each designation vary. When compared to the process of becoming a CGMA, it is much easier to be eligible as a CMA. Let’s explore in more detail below.

CMA Requirements

To become a CMA you must earn a bachelor’s degree, join the IMA and fulfill their 2-year consecutive work experience requirement, as well as pass the CMA exam. Work experience must be in a managerial role, but can be made up of public or private accounting, consulting, research or teaching.

The Handbook states:

Qualifying experience consists of positions requiring judgments regularly made employing the principles of management accounting and financial management. Such employment includes:

- Preparation of financial statements

- Financial planning and analysis

- Month-end close, also quarter and year-end close

- Auditing (external or internal)

- Budget preparation and reporting

- Manage general ledger and balance sheets

- Forecasting

- Company investment decision-making

- Costing analysis

- Risk evaluation

- Management information systems analysis

- Management accounting and auditing in government, finance, or industry

- Auditing in public accounting

- If you are unsure whether your work experience counts, you can submit a request with the IMA and they will make individual judgment calls.

CGMA Requirements

On the other hand, to join the CGMA you must go through the AICPA or CIMA.

The CIMA pathway is much more similar to the CMA. Candidates must fulfill 3 years of management accounting work experience, be a CIMA member and pass 12 individual CIMA exams.

For those that choose the AICPA route, you must be a member as well as be an active CPA. This means you must have passed all 4 parts of the CPA exam and earned that certificate prior to getting 3 years of management accounting work experience and then passing the CGMA exam.

If you are ready to start moving your career ahead, then the CMA is the quickest and best option. In order to go the CPA route, you would have to pass 16 exams in total, plus fulfill all the work experience and educational requirements, which would take significantly more time.

I’d be remiss if I didn’t mention a particularly shady aspect in the AICPA’s CGMA past though: when this designation was first launched, the AICPA essentially sold the certification to its current members for a fee.

These individuals weren’t required to fulfill any prerequisites or forced to take an exam. While this is undoubtedly unethical, what’s more troubling is that thousands of practicing CGMAs may not possess the skill or knowledge required for this designation.

Unsurprisingly, the IMA and its current CMAs were very disappointed. Thankfully, this issue was dealt with and, as of January 2015, all CGMA candidates are required to take the same 3-hour case-study final exam.

CGMA vs CMA: A Full Comparison

In terms of material covered in the required exams, the breadth of management accounting topics covered in the CMA exam far outweigh those of the CGMA exam.

The cost to prepare and take the exam also varies. Here is a quick breakdown of the essentials:

CMA | CGMA | |

Format | 2 Parts - MCQ and Essay | 1 Part - Case Study |

Duration | 4 hours - 3 hours for 100 Multiple Choice Questions and 1 hour for 2 essay questions | 3 hours - 3 x 60-minute sections |

Testing Windows | January, February, May, June, September, October | February, May, August, November |

Exam Cost | $460 per part plus a one-time entrance fee that ranges from $210-280 | Included in the annual membership fee. |

Review Course Cost | $1,000 - $2,400 depending on provider | $4,395 and provided directly by CGMA |

Designation Maintenance | CMA continuing education - 30 hours CPE per year + IMA membership fee ($45 - $275) | Membership fee of $495 + annual dues to AICPA (for CPAs) |

Do Employers Want CMAs or CGMAs?

Over the past few years, there has been an increasing need for CMAs in the workplace. As the designation becomes more internationally recognized, more and more employers are supporting it.

On top of being more well-known, employers are looking for the unique skills that CMAs possess in terms of management accounting and financial analysis.

This desire for CMAs isn’t exclusive to those in the United States either. It is widely recognized globally and especially popular in the Middle East with ever-growing numbers of candidates.

With only a handful of years of experience, the CGMA designation is slowly establishing itself. In fact, CGMA designates are found in 91 of the Fortune 100. However, this certification will need a few more years to establish itself in terms of reputation and execution of knowledge.

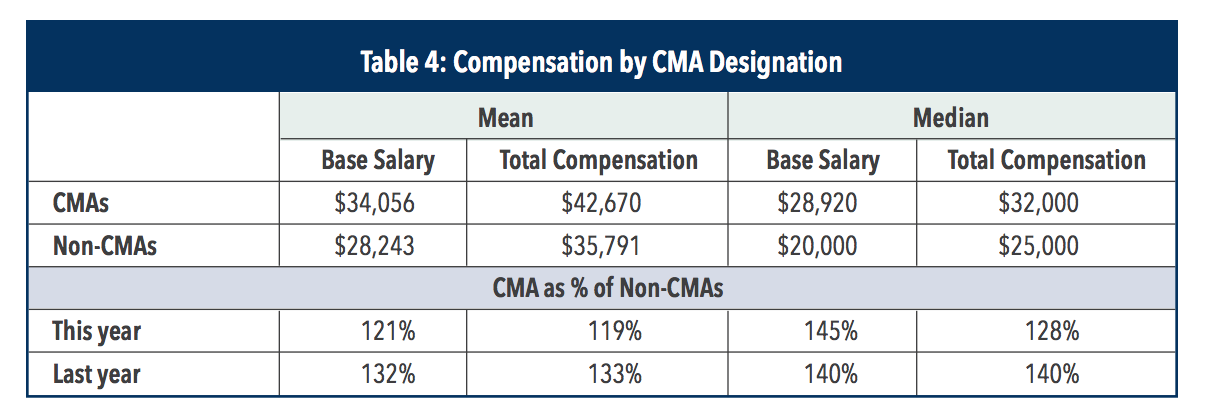

CMA Salary vs CGMA Salary

CMA salaries vs CGMA salaries compare favorably, though CMAs earn slightly more. The median CMA compensation in the US is $118,500 per year, according to the IMA. The average CGMA salary in the US is $89,000 per year, per recent statistics from the official CGMA website.

As this cannot be officially verified by either governing body, I highly recommend taking into consideration the IMA global salary survey to see what the average salary is in your country.

The non-CMA salaries in this survey may be a more accurate representation of your potential CGMA salary, based on the CGMA’s lack of popularity and relative newness.

When choosing a career it’s fairly safe to say that many people take salary into consideration. When you are financially investing in your future, then you want to make sure it has ROI. Overall, the CMA has a more established history of improving salary potential.

Is the CGMA or the CMA Worth It?

The decision to choose a CGMA over a CMA is a highly personal one. It really comes down to what your career goals are.

The CMA is a popular, affordable option that provides a wealth of technical knowledge. It also helps you earn the high-level leadership position you want by teaching strategic management and planning.

The truth is that becoming a CMA is challenging. But that’s why the designation is synonymous with excellence. Still, you shouldn’t let that deter you from making this important investment in yourself and your career. CMAs earn approximately 58% more than non-CMAs, so it’s clear that the certification has a great ROI.

If you’re ready to start studying for the exam, check out my CMA 16-Week Accelerator program. CMA Exam Academy students pass the CMA exam nearly twice as often as the global average, so you can trust that you’re in good hands.

Hi, I’m Nathan Liao (aka the CMA Coach)! For the last 10 years, over 82,000 accounting and finance pros came knocking at my door seeking guidance and help. If you’re also aiming to conquer the CMA exam on your very first try—without wasting away time or money—you’ve found your ultimate guide. Dive in deeper to discover more about me and the dedicated team that powers CMA Exam Academy. Click here and let’s embark on this journey together!

5 Comments on “CGMA vs CMA: Which Is the Best Accounting Designation?”

Thank you, Nathan!

I am relatively New in the Field of Accounting. I just completed my MBA with an emphasis on leadership.

I wanted to include the accounting portion of it to become a consultant!

I was debating between CGMA and CPA/CMA. Which route would you suggest for me?

Thanks

John

Hi John,

Based on your career goals, which one do you think is a better fit for you?

If you’re looking to become a tax consultant go for the CPA.

If you’re looking to be a management consultant, the CMA is a better fit.

Look at the topics tested in each designation and choose the one that fits you best.

Good and well done!

Thank you for your appreciation, Andrew!

Pingback: How to Become a CMA: 10 Steps to Getting Certified