Most accounting and finance professionals dread the month-end close process. It’s one of the most taxing tasks in accounting.

But accounting and finance departments must close the books each month and annually.

Accurate financial reporting is crucial. Month-end close allows finance departments to provide up-to-date information to stakeholders, including but not limited to account reconciliation, budget variance analysis, and statement generation (balance sheet, income statement, cash flow statement, etc.).

Month-end closing ensures all of a business’s financials are in order and running smoothly.

In this article, I’ll dig into the ins and outs of the month-end close process and why it’s necessary.

- What Is Month-End Close in Accounting?

- Why Is Month-End Closing Important?

- How Long Does Month-End Closing Take?

- How to Do the Month-End Close Process Faster in 10 Steps

- Month-End Close Checklist

- Month-End Closing: A Critical Process for Accountants

Are you looking to advance in your accounting career? Have you considered the CMA certification? The team at CMA Exam Academy has the resources you need to make the right decision for your career. Learn more about managerial accounting and decide whether it’s the path for you.

What Is Month-End Close in Accounting?

The month-end closing process is not just about ticking off items on a to-do list. It’s about ensuring accuracy and compliance and providing insights that drive better decision-making.

Here’s how it goes:

- Accountants review and reconcile the month’s transactions so all income, expenses, and adjustments are accurately recorded.

- Next, they reconcile bank statements, accounts payable and receivable, and other documents to identify errors.

- Accountants then prepare financial statements to provide a snapshot of the organization’s financial performance for all relevant stakeholders.

Financial data is a compass to guide businesses toward informed decisions and successful outcomes.

The month-end closing process is at the heart of the financial data of a company. The tasks accountants complete ensure:

- Regulatory compliance

- Financial accuracy

- Transparency

The essential closing period is the end of the financial year, but good accounting practice means closing your books at the end of every month.

The goal is to provide a snapshot of the company’s financial position and performance each month – which is critical for internal decision-making.

Why Is Month-End Closing Important?

Month-end closing bridges current operational activities and strategic planning for the future.

Here are five reasons month-end closing is a big deal:

1. Accurate Financial Reporting

Businesses rely on accurate financial statements to assess performance, make informed decisions, and comply with regulations.

Month-end closing ensures all transactions are correctly recorded, and financial statements accurately reflect the company’s financial position.

2. Data-Driven Decision Making

Timely and accurate data analytics is crucial for informed decision-making within the finance department and the larger organization.

By promptly closing the month’s books, leaders can analyze financial performance, identify trends, and adjust strategies accordingly.

3. Compliance and Regulation

Regulatory agencies require businesses to adhere to specific reporting standards and deadlines.

Proper closing ensures your company remains compliant, avoiding penalties and reputational damage.

4. Investor Confidence

Both internal and external investors rely on transparent financial reporting. A well-executed month-end close process enhances investor confidence and fosters organizational trust.

5. Operational Efficiency

The process provides an opportunity to review and improve the efficiency of financial operations.

Identifying bottlenecks and streamlining processes can earn you significant time and cost savings.

How Long Does Month-End Closing Take?

Depending on the size and speed of your accounting team, month-end closing could take 5-15 business days.

The more you can streamline and standardize your closing processes, the faster you can tackle closing. A company I used to work for had a 14 business day month-end close. After applying the strategies I’m sharing in this article, I was able to bring it down to 5 business days.

Here are some ideas to make your month-end closing more efficient:

- Use templates and checklists

- Implement company cut-offs

- Automate your systems

- Back up your data

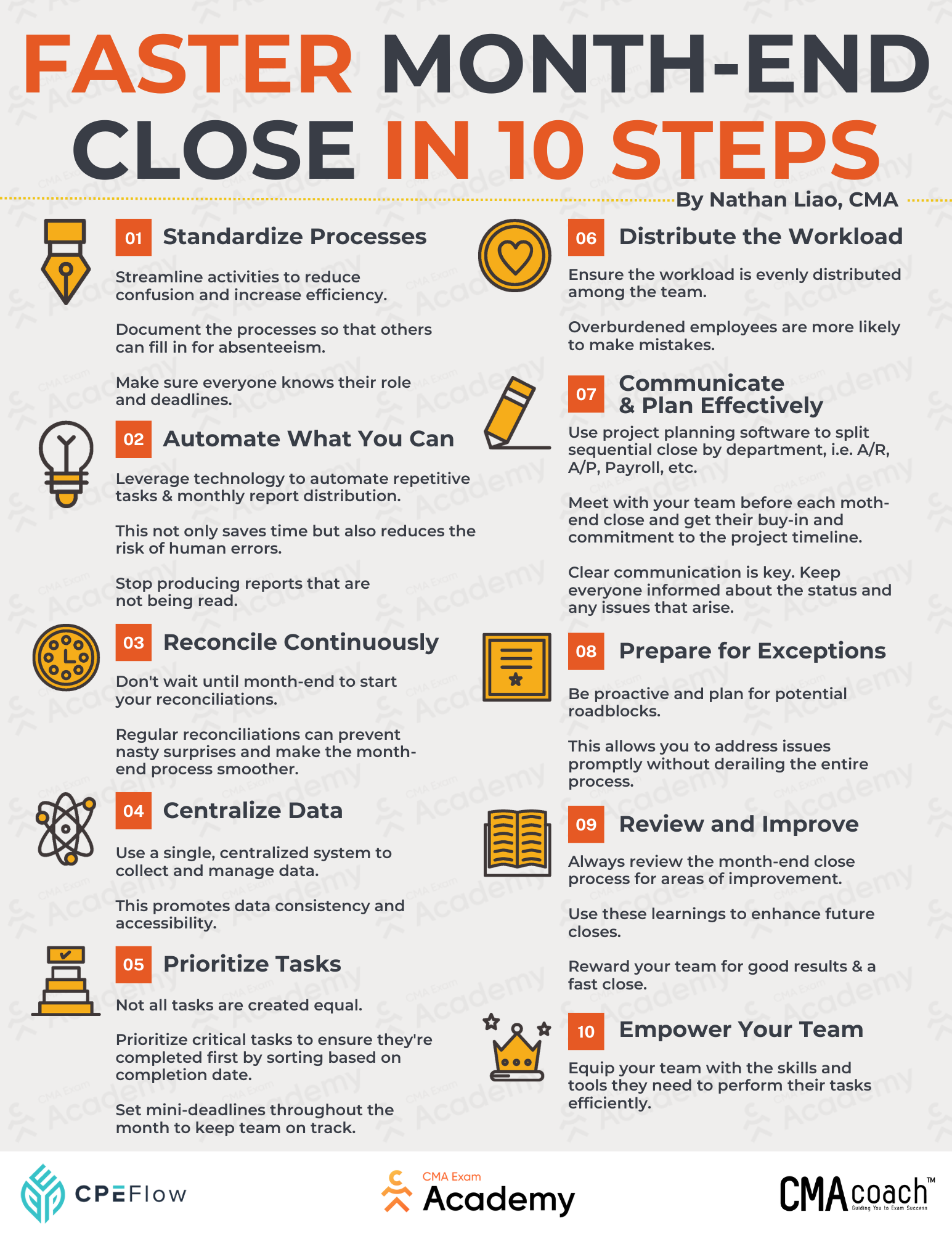

How to Do the Month-End Close Process Faster in 10 Steps

The process can be standardized, optimized, and organized so your team can tackle month-end closing as efficiently as possible.

Here are 10 steps to speed it up:

Step 1: Standardize Processes

I’ll say it again: streamline all related activities to reduce confusion and increase efficiency among your team.

It’s important that when the time comes for closing, everyone knows their roles and deadlines.

Step 2: Automate What You Can

Technology is beneficial in the closing process. Leverage new tech whenever possible to automate repetitive tasks.

Artificial intelligence and machine learning can be advantageous here; technology saves time and reduces the risk of human errors.

Want more intel on AI in accounting? Check out this video.

Step 3: Reconcile Continuously

It is a mistake to wait until month-end to reconcile.

Regular monthly reconciliations can prevent nasty surprises and make the process smoother.

Step 4: Centralize Data

Standardized data is vital.

A single centralized system to collect and manage data promotes consistency and accessibility.

Step 5: Prioritize Tasks

Not all tasks are created equal.

You and your team should prioritize critical functions so they’re completed first.

Step 6: Distribute the Workload

Overburdened employees are more likely to make mistakes.

Team leaders should evenly distribute the workload among the team. I used Microsoft Project to plan my month-end closing, and it helped me ensure the workload was distributed evenly to not overburden any employee.

Step 7: Communicate & Plan Effectively

Use project management software to split the close process by department.

You should hold a team meeting before the start of each closing and make sure each department (i.e., A/R, A/P, Payroll, etc.) is aware and bought-in to the project timeline. Maintain open communication with all relevant team members, departments, and stakeholders.

Keep everyone informed about the current status of closing and any issues that may arise.

Step 8: Prepare for Exceptions

Be proactive and plan for potential roadblocks so you can address issues promptly without derailing the entire process timeline.

Step 9: Review and Improve

At the end of closing, review your process to identify any areas of improvement, and share it with your team.

Implement any takeaways next month.

Step 10: Empower Your Team

Equip your team with any skills and tools they need to perform their tasks accurately and efficiently.

Month-End Close Checklist

A checklist for your month-end close process keeps your accounting organized and helps your team feel less dread at the end of the month.

One way to take advantage of continuing education is to use the knowledge gained to propel your career forward. The CMA might be the right path for you.

Month-End Closing: A Critical Process for Accountants

The month-end closing process is more than a routine task for accountants; it’s a cornerstone of the financial processes that drive business success.

By understanding its importance and utilizing my checklist, you can find success in your month-end process.

If you’re searching for career growth as an accountant, consider becoming a CMA. I have exam prep and resources on high-paying CMA roles.

Hi, I’m Nathan Liao (aka the CMA Coach)! For the last 10 years, over 82,000 accounting and finance pros came knocking at my door seeking guidance and help. If you’re also aiming to conquer the CMA exam on your very first try—without wasting away time or money—you’ve found your ultimate guide. Dive in deeper to discover more about me and the dedicated team that powers CMA Exam Academy. Click here and let’s embark on this journey together!