Understanding a company’s financial health is a vital skill for management accountants.

Financial statements provide a wealth of knowledge about a company’s financial health, and as an accountant, you need to be able to read, digest, and understand their content.

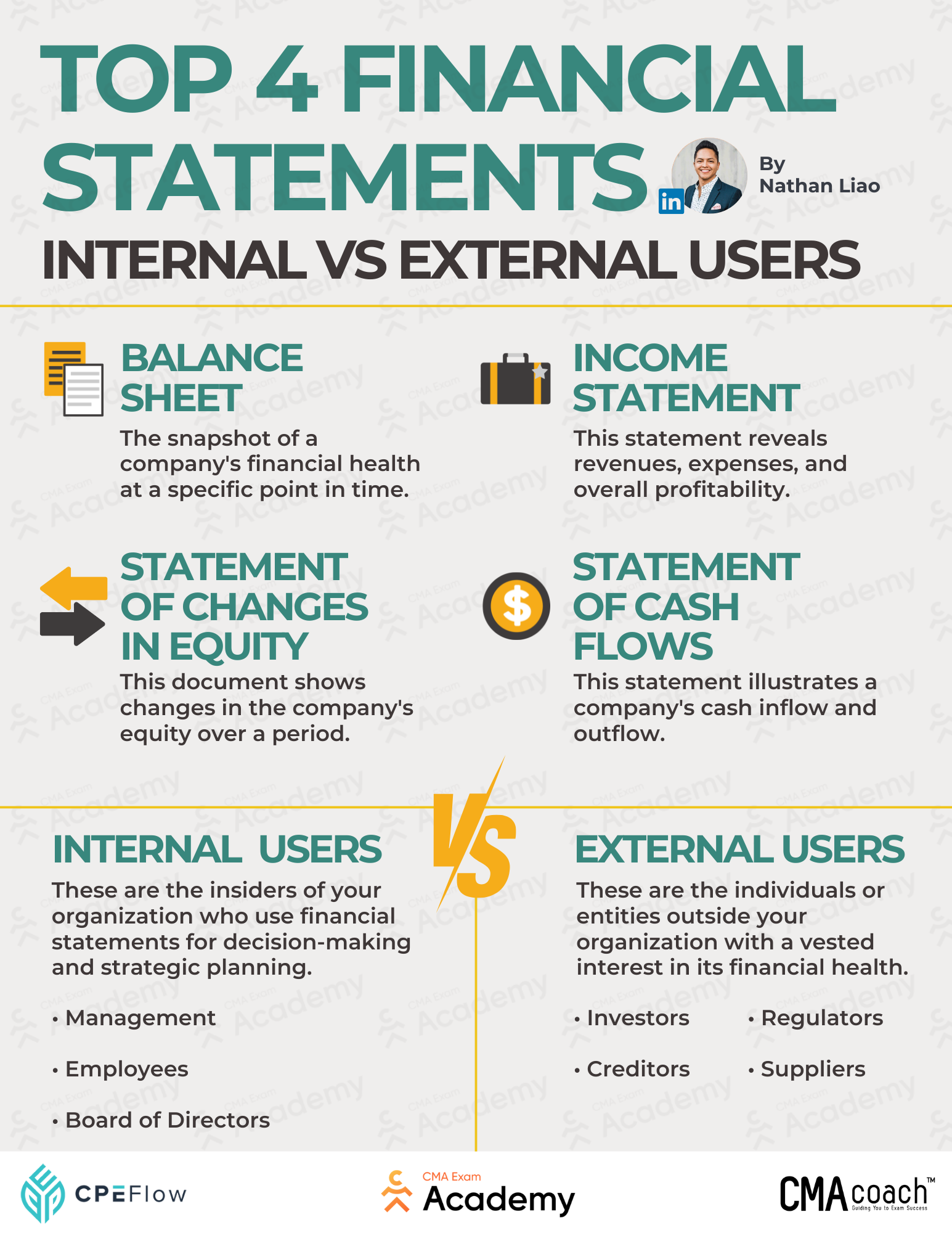

I’ve created this guide to break down financial statements, including the four kinds of financial statements, and how internal and external parties use them.

Let’s dive in.

- What Is a Financial Statement?

- How to Read a Financial Statement

- The Top 4 Main Financial Statements

- Who Needs Financial Statements

- Drawing Conclusions About Financial Health From Financial Statements

What Is a Financial Statement?

Financial statements are a collection of detailed records of a business’s activities and financial performance, offering a glimpse into a company’s financial health.

Financial statements illustrate the amount of money the company has on hand, the profit and loss of a specific period, information about equity, assets and liabilities, and income.

Financial statements are helpful for the following:

- Determining the ability to generate cash, plus the sources and uses of cash

- Deriving information on the business’s financial condition

- Investigation of certain significant business transactions

- Tracking financial results and forecasting trends

- Determining the capability of paying back debts

- Preparation of annual reports

- Equity position

- And much more

This information can inform budgeting, financial planning and analysis, product development, business strategy decisions, etc.

For accountants, a financial statement is vital in understanding your company’s financial position and current value.

You can increase your value as an employee by becoming an expert in preparing, analyzing, and understanding financial statements.

How to Read a Financial Statement

To fully understand your company’s financial position, you review and analyze all financial statements available – balance sheet, income statement, cash flow statement, and changes in equity statement.

I’ll explain each of these in more depth later in this article. Right now, I’d like to focus on some ratios and calculations you may encounter in financial statements.

- Inventory Turnover Ratio: The number of times a business has sold and then resupplied its inventory over a certain period of time.

- Cost of Sales / Average Inventory for the Period

- Operating Margin: The total amount of profit a business earns per dollar of sales after paying for costs of production – but before paying interest or tax.

- Income from Operations / Net Revenues

- P/E Ratio: Indicates what the market will pay for a stock based on past or future earnings.

- Price per Share / Earnings per Share

- Working Capital: The difference between the current assets and current liabilities of a business.

- Current Assets – Current Liabilities

Now that you understand how to calculate figures from the reports, let’s discuss how to read and analyze the statements. Here are a few ways to understand your company’s financial health:

- Compare current statements with previous ones and look for trends

- Assess any accrued debt and the ability to repay them

- Analyze investments and returns

- Review profit and loss

- Analyze expenses

The Top 4 Main Financial Statements

There are four main types of financial statements. Let’s discuss the included data in each and why it matters.

Balance Sheet

The balance sheet provides a snapshot of an organization’s assets, liabilities, and shareholders’ equity. While it cannot give insight into any trends on its own, it can when compared to balance sheets from previous periods.

The balance sheet is valuable in determining risk, securing capital, and measuring a company’s liquidity, solvency, and turnover.

The balance sheet is based on the following equation:

Assets = Liabilities + Shareholder’s Equity

In short, a company has to pay for everything it owns (assets) by borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity).

Let’s break it down further.

Assets are listed according to their liquidity – how easily they can be converted to cash. This could be cash, marketable securities, accounts receivable, inventory, prepaid expenses, and fixed and intangible assets.

Liabilities are any money owed, such as bills, interest, utilities, salaries, and long-term debt.

Shareholder equity is any money attributed to the company’s owners or shareholders.

Income Statement

The Income statement provides an overview of a company’s operations over a specific period, including revenue, cost of goods sold, gross profit, expenses, and net income.

Revenue breaks down into operating and non-operating revenues. Operating revenue is money earned by selling products or services. Non-operating revenue, or Gains, is made outside the core business, for instance, interest earned, income from partnerships, or the sale of long-term assets like land.

Expenses include cost of goods sold, administrative expenses, marketing, employee salaries, depreciation or amortization, etc.

Statement of Changes in Equity

This statement is named accurately – it tracks the changes in total equity over time.

While the formula to calculate the changes in equity will vary, there are a couple of standard components:

- Beginning Equity: the amount of equity at the end of the last period

- Net Income: income earned in the given period

- Dividends: amount paid to shareholders from profit

- Other comprehensive income: variation in owners’ equity, excluding investments by owners, during a specific period.

Statement of Cash Flows

The statement of cash flow measures a company’s ability to generate cash. The cash is used to pay debts and fund operations and investments.

Cash flow shows investors where a company’s money comes from and how that money is spent.

The three main components of a cash flow statement are:

- Operating Activities: any sources and uses of cash to operate the business and sell day-to-day

- Investing Activities: any sources or uses of money from investments

- Financing Activities: cash from investors or banks and the uses of cash paid to shareholders

Who Needs Financial Statements

Many people, inside and outside an organization, are interested in financial statements. The statements may be used and analyzed in various ways depending on the context.

Internal Use

Internally, financial statements are used to make strategic and operational decisions.

Management

A company’s management team prepares financial statements and refers to them while considering the company’s progress and growth to make data-informed decisions.

Employees

Employees may use their company’s financial statements for a few reasons. If their bonuses depend on the company’s financial performance, they may want to check in periodically. Additionally, employees may want to understand their company’s performance to evaluate their job security.

Board of Directors

The Board of Directors makes significant decisions on company leadership and their future direction. With comprehensive financial information, they can forecast the future and make informed decisions.

External Use

There are a few external uses for financial statements. If a company is publicly traded, they’re required to publish financial information for the benefit of investors. The financial reports are used by private companies to secure lines of credit for working capital and scale the business.

Investors

Investors need up-to-date information on financial performance to decide whether to keep investing or if the smart decision is to move out of the company.

Regulators

Regulators collect company data so investors, depositors, and creditors can better assess their financial condition.

Creditors

Creditors use a company’s financial history to determine whether they can repay debt.

Suppliers

Suppliers and vendors only want to work with financially healthy companies. This helps ensure a positive working relationship where suppliers are paid on time.

Drawing Conclusions About Financial Health From Financial Statements

No single financial statement tells the whole story of a company’s financial health. Knowing how to prepare, review, and analyze all four types–balance sheets, income statements, changes in equity statements, and cash flow statements will be beneficial.

Looking at the entire story, financial statements become a powerful tool for management accountants and other business leaders to assess a company’s overall health.

Both parts of the CMA exam cover financial statement analysis –15% of the first and 20% of the material covered in the second!

Think you’ve got it down? Let’s ace the exam together.

Hi, I’m Nathan Liao (aka the CMA Coach)! For the last 10 years, over 82,000 accounting and finance pros came knocking at my door seeking guidance and help. If you’re also aiming to conquer the CMA exam on your very first try—without wasting away time or money—you’ve found your ultimate guide. Dive in deeper to discover more about me and the dedicated team that powers CMA Exam Academy. Click here and let’s embark on this journey together!