As you know, the CMA exam is comprised of two parts. Each part is designed to test your knowledge and understanding of core competencies in management accounting.

And what you also may know is that many people struggle to pass the CMA exam. In fact, candidates have traditionally struggled the most with Part 1, with CMA pass rates averaging as low as 45% over the past few years.

This may be because CMA accounting candidates do not fully understand what is expected of them from each part of the exam.

To help you prepare like a rockstar, I will be breaking down everything you need to know about CMA Exam Part 1. Don’t worry; I will be dissecting CMA exam part 2 as well — stay tuned!

Note: Beginning September 2024, the CMA exam will change based on a recent Job Analysis study. Minor updates and additions will be made in the areas of data management, internal controls testing/remediation, data ethics, and business fraud.

- Skills Required to Pass CMA Part 1

- CMA Part 1 Study Time

- CMA Exam Part 1 Syllabus

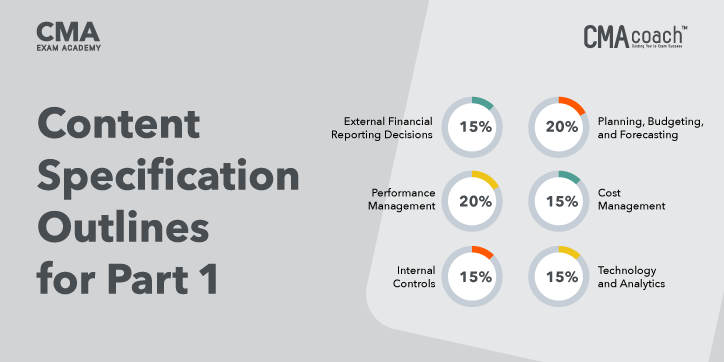

- Content Specification Outlines for Part One

- External Financial Reporting Decisions

- Planning, Budgeting, and Forecasting

- Performance Management

- Cost Management

- Internal Controls

- Technology and Analytics

- How to Pass CMA Part 1 Multiple-Choice Questions

- Understanding the Essay Section

- CMA Part 1 Grading

- CMA Part 1 vs. Part 2

Originally published on March 25th, 2020, this article was updated and republished on March 7th, 2024.

Skills Required to Pass CMA Part 1

The Institute of Certified Management Accountants prepares Content Specification Outlines (CSOs) that list the topics candidates will be tested on. Each subject is designated a “level”; A, B or C. These levels refer to the degree of coverage expected in each topic.

For example, Level A requires knowledge and comprehension. Level B requires knowledge, comprehension, application, and analysis. Level C requires six outlined skill levels, including knowledge, comprehension, application, analysis, synthesis, and evaluation.

Fun fact: the CMA exam tests you at a skill level C for all areas; meaning you must fully understand all the material.

What exactly do these skills require of you?

- Knowledge: Ability to recall material you previously learned

- Comprehension: Ability to interpret and explain material

- Application: Ability to demonstrate the use of material in a situation

- Analysis: Ability to break down material or recognize relationships between components and identify critical elements

- Synthesis: Ability to form hypotheses from different parts of material to create new operations

- Evaluation: Ability to criticize, justify and come to conclusions on material

CMA Part 1 Study Time

On their website, the Institute of Management Accountants (IMA) recommends 170 hours of study time for part 1 of the CMA exam. These hours should be completed over the course of between 10 and 13 weeks.

Part 2 of the CMA exam requires less time studying — approximately 130 hours over the course of 8 to 11 weeks. In total, that amounts to a minimum of 18 to 24 weeks of study time for both parts.

Now, if you are a professional with a full-time job, this number will increase and more so significantly if you choose to self-study. I know that may be discouraging, but don’t worry. There are resources to help you.

My CMA exam review course is designed to help you cut that number in half. I’ve developed a 16-week accelerator study program that is guaranteed to help you pass the exam on your first try. And the results speak for themselves – my students have a pass rate that is nearly double the global average.

If you’re in the process of beginning a CMA exam study plan, check out my complete CMA review course!

CMA Exam Part 1 Syllabus

Part 1 of the CMA certification test covers Financial Planning, Performance, and Analytics.

This 4-hour long exam is comprised of 100 multiple-choice questions and two essay questions. I prefer to call these essay “scenarios,” as each question requires you to present written and quantitative responses.

Six topics are covered in CMA Part 1:

- External Financial Reporting Decisions 15%

- Planning, Budgeting, and Forecasting 20%

- Performance Management 20%

- Cost Management 15%

- Internal Controls 15%

- Technology and Analytics 15%

Content Specification Outlines for Part One

Now that you know what topics are going to be covered, let’s talk a little bit more about what precisely you need to know.

External Financial Reporting Decisions

Making up 15% of the exam material, you will be tested on Financial Statements, and Recognition, Measurement, Valuation, and Disclosure.

Financial Statements

For the balance sheet, income statement, statement of changes in equity, and the statement of cash flows, you should be able to:

- Identify the users of these financial statements and their needs

- Demonstrate an understanding of the purposes and uses of each statement

- Identify the major components and classifications of each statement

- Identify the limitations of each financial statement

- Identify how various financial transactions affect the elements of each of the financial statements and determine the proper classification of a given transaction

- Demonstrate an understanding of the relationship among the financial statements

- Demonstrate an understanding of how a balance sheet, an income statement, a statement of changes in equity, and a statement of cash flows (indirect method) are prepared

With respect to consolidated financial statements prepared under U.S. GAAP, the candidate should be able to:

- Define consolidated financial statements

- Define the two types of consolidation models: variable interest entity model and voting interest model

- Demonstrate an understanding of the three types of consolidation accounting: full consolidation, proportionate consolidation, and equity consolidation

- Demonstrate an understanding of intracompany balances and transactions that should be eliminated in consolidation

With respect to integrated reporting, the candidate should be able to:

- Define integrated reporting, integrated thinking, and the integrated report, and demonstrate an understanding of the relationship among them

- Identify the primary purpose of integrated reporting

- Explain the fundamental concepts of value creation, the six capitals, and the value creation process

- Identify elements of an integrated report (i.e., organizational overview and external environment, governance, business model, risks and opportunities, strategy and resource allocation, performance, outlook, and basis of preparation and presentation)

- Identify and explain the benefits and challenges of adopting integrated reporting

Recognition, Measurement, and Valuation

You should feel comfortable with:

Asset Valuation

- Identify issues related to the valuation of accounts receivable, including timing of recognition and estimation of the allowance for credit losses

- Distinguish between receivables sold (factoring) on a with-recourse basis and those sold on a without-recourse basis, and determine the effect on the balance sheet

- Identify issues in inventory valuation, including which goods to include, what costs to include, and which cost assumption to use

- Identify and compare cost flow assumptions used in accounting for inventories

- Demonstrate an understanding of the lower of cost or market rule for LIFO and the retail inventory method, and the lower of cost and net realizable value rule for all other inventory methods

- Calculate the effect on income and on assets of using different inventory methods

- Analyze the effects of inventory errors

- Identify advantages and disadvantages of the different inventory methods

- Recommend the inventory method and cost flow assumption that should be used for a company given a set of facts

- Demonstrate an understanding of the following debt security types: trading, available-for-sale, and held-to-maturity

- Demonstrate an understanding of the valuation of debt and equity securities

- Determine the effect on the financial statements of using different depreciation methods

- Recommend a depreciation method for a given set of data

- Demonstrate an understanding of the accounting for impairment of long-term assets and intangible assets, including goodwill

Valuation of Liabilities

- Identify the classification issues of short-term debt expected to be refinanced

- Compare the effect on financial statements when using either the assurance warranty approach or the service warranty approach for accounting for warranties

Income taxes (applies to Assets and Liabilities subtopics)

- Demonstrate an understanding of interperiod tax allocation/deferred income taxes

- Distinguish between deferred tax liabilities and deferred tax assets

- Differentiate between temporary differences and permanent differences, and identify examples of each

Leases (applies to Assets and Liabilities subtopics)

- Distinguish between operating and finance leases

- Recognize the correct financial statement presentation of operating and finance leases

Equity transactions

- Identify transactions that affect paid-in capital and those that affect retained earnings

- Determine the effect on shareholders’ equity of large and small stock dividends, and stock splits

Revenue recognition

- Apply revenue recognition principles to various types of transactions

- Demonstrate an understanding of revenue recognition for contracts with customers using the steps required to recognize revenue

- Demonstrate an understanding of the matching principle with respect to revenues and expenses, and be able to apply it to a specific situation

Income measurement

- Define gains and losses, and indicate the proper financial statement presentation for gains and losses

- Demonstrate an understanding of the treatment of gain or loss on the disposal of fixed assets

- Demonstrate an understanding of expense recognition practices

- Define and calculate comprehensive income

- Identify the correct treatment of discontinued operations

GAAP – IFRS differences

Major differences in reported financial results when using GAAP vs. IFRS and the impact on analysis:

- Identify and describe the following differences between U.S. GAAP and IFRS: expense recognition, with respect to share-based payments and employee benefits; intangible assets, with respect to development costs and revaluation; inventories, with respect to costing methods, valuation, and write-downs (e.g., LIFO); leases, with respect to lessee operating and finance leases; long-lived assets, with respect to revaluation, depreciation, and capitalization of borrowing costs; and impairment of assets, with respect to determination, calculation, and reversal of loss

Planning, Budgeting, and Forecasting

This section makes up 20% of CMA Part 1 and covers six areas of competency.

Strategic Planning

In this section, you will need to understand everything that goes into strategic planning, such as:

- Discussing how strategic planning determines the path an organization chooses for attaining its long-term goals, vision, and mission, and distinguish between vision and mission

- Identifying the time frame appropriate for a strategic plan

- Identifying the external factors that should be analyzed during the strategic planning process and understanding how this analysis leads to the recognition of organizational opportunities, limitations, and threats

- Identifying the internal factors that should be analyzed during the strategic planning process and explaining how this analysis leads to the recognition of organizational strengths, weaknesses, and competitive advantages

- Demonstrating an understanding of how an organization’s mission leads to the formulation of long-term business objectives, such as business diversification, the addition or deletion of product lines, or the penetration of new markets

- Explaining why short-term objectives, tactics for achieving these objectives, and operational planning (master budget) must be congruent with the strategic plan and contribute to the achievement of long-term strategic goals

- Identifying the characteristics of successful strategic plans

- Describing Porter’s generic strategies, including cost leadership, differentiation, and focus

- Demonstrating an understanding of the following planning tools and techniques: SWOT analysis, Porter’s Five forces, situational analysis, PEST analysis, scenario planning, competitive analysis, contingency planning, and the BCG Growth-Share Matrix

Budgeting Concepts

Not to be confused with budgeting methodologies, the budgeting concepts included are:

- The role that budgeting plays in the overall planning and performance evaluation process of an organization

- The interrelationships between economic conditions, industry situation,

- and an organization’s plans and budgets

- The role that budgeting plays in formulating short-term objectives and in planning and controlling operations to meet those objectives

- The role that budgets play in measuring performance against established goals

- The characteristics that define successful budgeting processes

- The budgeting process facilitates communication among

- organizational units and enhances coordination of organizational activities

- The concept of a controllable cost as it relates to both budgeting and performance evaluation

- The efficient allocation of organizational resources is planned during the budgeting process

- The appropriate time frame for various types of budgets

- Who should participate in the budgeting process for optimum success

- The role of top management in successful budgeting

- The use of cost standards in budgeting

- Differentiate between ideal (theoretical) standards and currently attainable (practical) standards

- Differentiate between authoritative standards and participative standards

- The steps to be taken in developing standards for both direct material and direct labor

- The techniques that are used to develop standards, such as activity analysis and the use of historical data

- The importance of a policy that allows budget revisions that accommodate the impact of significant changes in budget assumptions

- The role of budgets in monitoring and controlling expenditures to meet strategic objectives

- The role of budgetary slack and its impact on goal congruence

Forecasting Techniques

Make sure you brush up on the following to tackle this section:

- Demonstrate an understanding of a simple regression equation

- Define a multiple regression equation

- Calculate the result of a simple regression equation

- Demonstrate an understanding of learning curve analysis

- Calculate the results under a cumulative average-time learning model

- Identify the benefits and shortcomings of regression analysis and learning curve analysis

- Calculate the expected value of random variables

- Identify the benefits and shortcomings of the expected value technique

- Use probability values to estimate future cash flows

Budgeting Methodologies

There are many different ways to budget. Make sure you understand the difference between:

Annual business plans (master budgets)

Project budgeting

Activity-based budgeting

Zero-based budgeting

Continuous (rolling) budgets

Flexible budgeting

You will be tested on the following competencies related to budgeting methods:

- Define its purpose, appropriate use, and time frame

- Identify the budget components and explain the interrelationships among the components

- Demonstrate an understanding of how the budget is developed

- Compare the benefits and limitations of the budget system

- Evaluate a business situation and recommend an appropriate budget solution

- Prepare budgets on the basis of information presented

- Calculate the impact of incremental changes to budgets

Annual Profit Plan and Supporting Schedules

Planning is essential, and this concept covers the following types of budgets:

Operational Budgets

Financial Budgets

Capital Budgets

You should expect questions around the following:

- Explain the role of the sales budget in the development of an annual profit plan

- Identify the factors that should be considered when preparing a sales forecast

- Identify the components of a sales budget and prepare a sales budget

- Explain the relationship between the sales budget and the production budget

- Identify the role that inventory levels play in the preparation of a production

- budget and define other factors that should be considered when preparing a production budget

- Prepare a production budget

- Demonstrate an understanding of the relationship between the direct materials budget, the direct labor budget, and the production budget

- Explain how inventory levels and procurement policies affect the direct materials budget

- Prepare a direct materials budget and a direct labor budget based on relevant information and evaluate the feasibility of achieving production goals on the basis of these budgets

- Demonstrate an understanding of the relationship between the overhead budget and the production budget

- Separate costs into their fixed and variable components

- Prepare an overhead budget

- Identify the components of a cost of goods sold budget and prepare a cost of goods sold budget

- Demonstrate an understanding of contribution margin per unit and total contribution margin, identify the appropriate use of these concepts, and calculate both unit and total contribution margin

- Identify the components of a selling and administrative expense budget

- Explain how specific components of the selling and administrative expense budget may affect the contribution margin

- Prepare an operational (operating) budget

- Prepare a capital expenditure budget

- Demonstrate an understanding of the relationship between the capital expenditure budget, the cash budget, and the pro forma financial statements

- Define the purposes of a cash budget and describe the relationship between the cash budget and all other budgets

- Demonstrate an understanding of the relationship between credit policies and purchasing (payables) policies and the cash budget

- Prepare a cash budget

Top-Level Planning and Analysis

This section will dive into topics like:

Pro forma income

Financial statement projects

Cash flow projections

You should be prepared to tackle the following:

- Define the purpose of a pro forma income statement, a pro forma balance sheet, and a pro forma statement of cash flows, and demonstrate an understanding of the relationship among these statements and all other budgets

- Prepare pro forma income statements based on several revenue and cost assumptions

- Evaluate whether a company has achieved strategic objectives based on pro forma income statements

- Use financial projections to prepare a pro forma balance sheet and a pro forma statement of cash flows

- Identify the factors required to prepare medium- and long-term cash forecasts

- Use financial projections to determine required outside financing and dividend policy

Performance Management

Making up 20% of your Part 1 exam, this section covers three main areas:

Cost and Variance Measures

- Analyze performance against operational goals using measures based on revenue, manufacturing costs, nonmanufacturing costs, and profit depending on the type of center or unit being measured

- Explain the reasons for variances within a performance monitoring system

- Prepare a performance analysis by comparing actual results to the master budget, calculate favorable and unfavorable variances from the budget, and provide explanations for variances

- Identify and describe the benefits and limitations of measuring performance by comparing actual results to the master budget

- Analyze a flexible budget based on actual sales (output) volume

- Calculate the sales-volume variance and the sales-price variance

- Calculate the flexible-budget variance by comparing actual results to the flexible budget

- Investigate the flexible-budget variance to determine individual differences between actual and budgeted input prices and input quantities

- Explain how budget variance reporting is utilized in a management-by-exception environment

- Define a standard costing system and identify the reasons for adopting a standard costing system

- Demonstrate an understanding of price (rate) variances and calculate the price variances related to direct material and direct labor inputs

- Demonstrate an understanding of efficiency (usage) variances and calculate the efficiency variances related to direct material and direct labor inputs

- Demonstrate an understanding of spending and efficiency variances as they relate to fixed and variable overhead

- Calculate a sales-mix variance and explain its impact on revenue and contribution margin

- Calculate and explain a mix variance

- Calculate and explain a yield variance

- Demonstrate how price, efficiency, spending, and mix variances can be applied in service companies as well as in manufacturing companies

- Analyze factory overhead variances by calculating variable overhead spending variance, variable overhead efficiency variance, fixed overhead spending variance, and production volume variance

- Analyze variances, identify causes, and recommend corrective actions

Responsibility Centers and Reporting Segments

- Identify and explain the different types of responsibility centers

- Recommend appropriate responsibility centers given a business scenario

- Calculate a contribution margin

- Analyze a contribution margin report and evaluate performance

- Identify segments that organizations evaluate, including product lines, geographical areas, or other meaningful segments

- Explain why the allocation of common costs among segments can be an issue in performance evaluation

- Identify methods for allocating common costs such as stand-alone cost allocation and incremental cost allocation

- Define transfer pricing and identify the objectives of transfer pricing

- Identify the methods for determining transfer prices, and list and explain the advantages and disadvantages of each method

- Calculate transfer prices using variable cost, full cost, market price, negotiated price, and dual-rate pricing

- Explain how transfer pricing is affected by business issues, such as the presence of outside suppliers and the opportunity costs associated with capacity usage

- Describe how special issues such as tariffs, exchange rates, taxes, currency restrictions, expropriation risk, and the availability of materials and skills affect performance evaluation in multinational companies

Performance Measures

- Explain why performance evaluation measures should be directly related to strategic and operational goals and objectives, why timely feedback is critical, and why performance measures should be related to the factors that drive the element being measured (e.g., cost drivers and revenue drivers)

- Explain the issues involved in determining product profitability, business unit profitability, and customer profitability, including cost measurement, cost allocation, investment measurement, and valuation

- Calculate product-line profitability, business unit profitability, and customer profitability

- Evaluate customers and products on the basis of controllable margin and recommend ways to improve profitability and/or drop unprofitable customers and products

- Define and calculate ROI

- Analyze and interpret ROI calculations

- Define and calculate residual income (RI)

- Analyze and interpret RI calculations

- Compare the benefits and limitations of ROI and RI as measures of performance and explain their appropriate usage

- Explain how revenue and expense recognition policies may affect the measurement of income and reduce comparability among business units

- Explain how inventory measurement policies, joint asset sharing, and overall asset measurement policies may affect the measurement of investment and reduce comparability among business units

- Define critical success factors (CSFs) and KPIs and discuss the importance of these measures in evaluating an organization

- Define the concept of a balanced scorecard and identify its components

- Identify and describe the perspectives of a balanced scorecard, including financial, customer, internal process, and learning and growth

- Identify and describe the characteristics of an effective balanced scorecard

- Demonstrate an understanding of a strategy map and the role it plays

- Analyze and interpret a balanced scorecard and evaluate performance based on the analysis

- Recommend performance measures and a periodic reporting methodology given operational goals and actual results

To nail this part, you should understand the ins and outs of actual vs. planned results, how to use flexible budgets to analyze performance, and be able to analyze cost expectations

Additionally, you will need to know the different types of responsibility centers and how to analyze profitability and return on investment using key performance indicators.

Cost Management

For 15% of the mark, you must be able to complete calculations related to various costing methodologies.

The core concepts covered are:

Measurement Concepts

You should feel comfortable performing the following activities:

- Calculate fixed, variable, and mixed costs, and demonstrate an understanding of the behavior of each in the long and short term and how a change in assumptions regarding cost type or relevant range affects these costs

- Identify cost objects and cost pools, and assign costs to appropriate activities

- Demonstrate an understanding of the nature and types of cost drivers and the causal relationship that exists between cost drivers and costs incurred

- Demonstrate an understanding of the various methods for measuring costs and accumulating work-in-process and finished goods inventories

- Identify and define cost measurement techniques, such as actual costing, normal costing, and standard costing; calculate costs using each of these techniques; identify the appropriate use of each technique; and describe the benefits and limitations of each technique

- Demonstrate an understanding of variable (direct) costing and absorption (full) costing and the benefits and limitations of these measurement concepts

- Calculate inventory costs, cost of goods sold, and operating profit using both variable costing and absorption costing

- Demonstrate an understanding of how the use of variable costing or absorption costing affects the value of inventory, cost of goods sold, and operating income

- Prepare summary income statements using variable costing and absorption costing

- Determine the appropriate use of joint product and by-product costing

- Demonstrate an understanding of concepts such as split-off point and separable costs

- Determine the allocation of joint product and by-product costs using the physical measure method, the sales value at split-off method, constant gross profit (gross margin) method, and the net realizable value method, and describe the benefits and limitations of each method

Costing Systems

For job order costing and activity-based costing, the candidate should be able to:

- Define the nature of the system, understand the cost flows of the system, and identify its appropriate use

- Calculate inventory values and cost of goods sold

- Demonstrate an understanding of the proper accounting for normal and abnormal spoilage

- Discuss the strategic value of cost information regarding products and services, pricing, overhead allocations, and other issues

- Identify and describe the benefits and limitations of each cost accumulation system

For specific cost accumulation systems:

- Demonstrate an understanding of process costing and the concept of equivalent units (no calculations required)

- Define the elements of activity-based costing, such as cost pool, cost driver, resource driver, activity driver, and value-added activity

- Calculate product cost using an activity-based system, and compare and analyze the results with costs calculated using a traditional system

- Explain how activity-based costing can be utilized in service companies

- Demonstrate an understanding of the concept of life-cycle costing and the strategic value of including upstream costs, manufacturing costs, and downstream costs

Overhead Costs

To demonstrate your understanding of overhead costs, you should feel comfortable with the following:

- Distinguish between fixed and variable overhead expenses

- Determine the appropriate time frame for classifying both variable and fixed overhead expenses

- Demonstrate an understanding of the different methods of determining overhead rates (e.g., corporate-wide rates, departmental rates, and individual cost driver rates)

- Describe the benefits and limitations of each of the methods used to determine overhead rates

- Identify the components of variable overhead expense

- Determine the appropriate allocation base for variable overhead expenses

- Calculate the per-unit variable overhead expense

- Identify the components of fixed overhead expense

- Identify the appropriate allocation base for fixed overhead expense

- Calculate the fixed overhead application rate

- Describe how fixed overhead can be over- or under-applied and how this difference should be accounted for in the cost of goods sold, work-in-process, and finished goods accounts

- Compare traditional overhead allocation with activity-based overhead allocation

- Calculate overhead expense in an activity-based costing setting

- Identify and describe the benefits derived from activity-based overhead allocation

- Explain why companies allocate the cost of service departments such as human

- resources or information technology to divisions, departments, or activities

- Calculate service or support department cost allocations using the direct method, the reciprocal method, the step-down method, and the dual allocation method

- Demonstrate an understanding of how regression can be used to estimate fixed costs

Supply Chain Management

On the CMA exam part 1, you should be able to:

- Explain supply chain management

- Define lean resource management techniques

- Identify and describe the operational benefits of implementing lean resource management techniques

- Define material requirements planning (MRP)

- Identify and describe the operational benefits of implementing a just-in-time (JIT) system

- Identify and describe the operational benefits of ERP

- Explain the concept of outsourcing and identify the benefits and limitations of choosing this option

- Describe how capacity level affects product costing, capacity management, pricing decisions, and financial statements

- Explain how using practical capacity as the denominator for the fixed cost allocation rate enhances capacity management

- Calculate the financial impact of implementing the above-mentioned methods

Business Process Improvement

- Define value chain analysis

- Identify the steps in value chain analysis

- Explain how value chain analysis is used to better understand a company’s competitive advantage

- Define, identify, and provide examples of a value-added activity and explain how the value-added concept is related to improving performance

- Demonstrate an understanding of process analysis and business process reengineering, and calculate the resulting savings

- Define best practice analysis and discuss how it can be used by an organization to improve performance

- Demonstrate an understanding of benchmarking process performance

- Identify the benefits of benchmarking in creating a competitive advantage

- Explain the relationship between continuous improvement techniques and quality performance

- Explain the concept of continuous improvement and how it relates to implementing ideal standards and quality improvements

- Identify and describe the components of the costs of quality, commonly referred to as prevention costs, appraisal costs, internal failure costs, and external failure costs

- Calculate the financial impact of implementing the above-mentioned processes

Internal Controls

This section can be tricky because the concepts covered are mostly conceptual. Candidates may struggle to find the right answer when there are several that seem correct. Worth 15% of the exam, make sure you pay attention to the topics below when studying to ensure you understand them.

Governance, Risk, and Compliance

This topic covers risk control and policies for safeguarding assurances internally, as well as external audit requirements and corporate governance. Specifically:

- Demonstrate an understanding of internal control risk and the management of internal control risk

- Identify and describe internal control objectives

- Explain how a company’s organizational structure, policies, objectives, and goals, as well as its management philosophy and style, influence the scope and effectiveness of the control environment

- Identify the Board of Directors’ responsibilities with respect to ensuring that the company is operated in the best interest of shareholders

- Identify the hierarchy of corporate governance (i.e., articles of incorporation, bylaws, policies, and procedures)

- Demonstrate an understanding of corporate governance, including rights and responsibilities of the CEO, the CFO, the Board of Directors, the audit committee, managers, and other stakeholders; and the procedures for making corporate decisions

- Describe how internal controls are designed to provide reasonable (but not absolute) assurance regarding the achievement of an entity’s objectives involving (i) effectiveness and efficiency of operations, (ii) reliability of financial reporting, and (iii) compliance with applicable laws and regulations

- Explain why personnel policies and procedures are integral to an efficient control environment

- Define and give examples of the segregation of duties

- Explain why the following four types of functional responsibilities should be performed by different departments or different people within the same function: (i) authority to execute transactions, (ii) recording transactions, (iii) custody of assets involved in the transactions, and (iv) periodic reconciliations of the existing assets to recorded amounts

- Demonstrate an understanding of the importance of independent checks and verification

- Identify examples of safeguarding controls

- Explain how the use of prenumbered forms, as well as specific policies and procedures detailing who is authorized to receive specific documents, is a means of control

- Define inherent risk, control risk, and detection risk

- Define and distinguish between preventive controls and detective controls

- Describe the major internal control provisions of the Sarbanes-Oxley Act

- Identify the role of the Public Company Accounting Oversight Board (PCAOB) in providing guidance on the auditing of internal controls

- Differentiate between a top-down (risk-based) approach and a bottom-up approach to auditing internal controls

- Identify the PCAOB preferred approach to auditing internal controls

- Identify and describe the major internal control provisions of the Foreign Corrupt Practices Act

- Identify and describe the five major components of COSO’s Internal Control-Integrated Framework

- Assess the level of internal control risk within an organization and recommend risk mitigation strategies

- Demonstrate an understanding of external auditor responsibilities, including the types of audit opinions that external auditors issue

- Identify and explain methods for testing the adequacy of internal controls, including inquiry, observation, inspection, and re-performance

- Explain how to remediate internal control deficiencies

Systems Controls and Security Measures

This section covers all sorts of controls, from network to backup controls, as well as business continuity planning. Here’s the full list:

- Describe how the segregation of accounting duties can enhance systems security

- Identify threats to information systems, including input manipulation, program alteration, direct file alteration, data theft, sabotage, viruses, Trojan horses, theft, and phishing

- Demonstrate an understanding of how system development controls are used to enhance the accuracy, validity, safety, security, and adaptability of systems input, processing, output, and storage functions

- Identify procedures to limit access to physical hardware

- Identify means by which management can protect programs and databases from unauthorized use

- Identify input controls, processing controls, and output controls and describe why each of these controls is necessary

- Identify and describe the types of storage controls and demonstrate an understanding of when and why they are used

- Identify and describe the inherent risks of using the internet as compared to data transmissions over secured transmission lines

- Define data encryption and describe why there is a much greater need for data encryption methods when using the internet

- Identify a firewall and its uses

- Demonstrate an understanding of how flowcharts of activities are used to assess controls

- Explain the importance of backing up all program and data files regularly and storing the backups at a secure remote site

- Define business continuity planning

- Define the objective of a disaster recovery plan and identify the components of such a plan, including hot, warm, and cold sites

Technology and Analytics

The final 15% of CMA Part 1 covers information systems, data governance, technology-enabled finance transformation, and data analytics.

Obviously, the focus is on analytics and how accounting technology plays a part in it, so be sure to understand accounting information systems, data policies and procedures, process automation and applications, and business intelligence. Here’s the full breakdown:

Information Systems

- Identify the role of the accounting information system (AIS) in the value chain

- Demonstrate an understanding of the accounting information system cycles, including revenue to cash, expenditures, production, human resources and payroll, financing, and property, plant, and equipment, as well as the general ledger and reporting system

- Identify and explain the challenges of having separate financial and nonfinancial systems

- Define ERP and identify and explain the advantages and disadvantages of ERP

- Explain how ERP helps overcome the challenges of separate financial and nonfinancial systems, integrating all aspects of an organization’s activities

- Define relational database and demonstrate an understanding of a database management system

- Define data warehouse and data mart

- Define enterprise performance management (EPM) (also known as corporate performance management (CPM) or business performance management (BPM))

- Discuss how EPM can facilitate business planning and performance management

Data Governance

- Define data governance and data management

- Demonstrate a general understanding of data governance frameworks, including COSO’s Internal Control-Integrated Framework

- Identify the stages of the data life cycle, i.e., data capture, data maintenance, data synthesis, data usage, data analytics, data publication, data archival, and data purging

- Demonstrate an understanding of data preprocessing and the steps to convert data for further analysis, including data consolidation, data cleaning (cleansing), data transformation, and data reduction

- Discuss the importance of having a documented record retention (or records management) policy

- Identify and explain controls and tools to detect and thwart cyberattacks, such as penetration and vulnerability testing, biometrics, advanced firewalls, and access controls

Technology-Enabled Finance Transformation

- Define the system development life cycle, including systems analysis, conceptual design, physical design, implementation and conversion, and operations and maintenance

- Explain the role of business process analysis in improving system performance

- Define robotic process automation (RPA) and its benefits

- Evaluate where technologies can improve the efficiency and effectiveness of processing accounting data and information (e.g., artificial intelligence (AI))

- Define cloud computing and describe how it can improve efficiency

- Define software-as-a-service (SaaS) and explain its advantages and disadvantages

- Recognize potential applications of blockchain, distributed ledger, and smart contracts

Data Analytics

Business intelligence

- Define Big Data and explain the volume, velocity, variety, and veracity of Big Data; and describe the opportunities and challenges of leveraging insight from this data

- Explain how structured, semi-structured, and unstructured data is used by a business enterprise

- Describe the progression of data, from data to information to knowledge to insight to action

- Describe the opportunities and challenges of managing data analytics

- Explain why data and data science capability are strategic assets

- Define business intelligence (BI) (i.e., the collection of applications, tools, and best practices that transform data into actionable information in order to make better decisions and optimize performance)

Data mining

- Define data mining

- Describe the challenges of data mining

- Explain why data mining is an iterative process and both an art and a science

- Explain the purpose of Structured Query Language (SQL) and explain its purpose

- Describe how an analyst would mine large data sets to reveal patterns and provide insights

Types of data analytics

- Explain the challenge of fitting an analytics model to the data

- Define the different types of data analytics, including descriptive, diagnostic, predictive, and prescriptive

- Define clustering and classification, and determine when each of these analytic techniques would be the appropriate tool to use

- Demonstrate an understanding of multiple regression and logistic regression and recognize when these techniques are appropriate

- Calculate the result of multiple regression equations as applied to a specific situation

- Demonstrate an understanding of the coefficient of determination (R squared) and the correlation coefficient (R)

- Demonstrate an understanding of time series analyses, including trend, cyclical, seasonal, and irregular patterns

- Identify and explain the benefits and limitations of regression analysis and time series analysis

- Define standard error of the estimate, goodness of fit, and confidence interval

- Explain how to use predictive analytics techniques to draw insights and make recommendations

- Describe exploratory data analysis and how it is used to reveal patterns and discover insights

- Define sensitivity analysis and identify when it would be the appropriate tool to use

- Demonstrate an understanding of the uses of simulation models, including the Monte Carlo technique

- Identify the benefits and limitations of sensitivity analysis and simulation models

- Demonstrate an understanding of what-if (or goal-seeking) analysis

- Identify and explain the limitations of data analytics

Data visualization

- Utilize table and graph design best practices to avoid distortion in the communication of complex information

- Evaluate data visualization options and select the best presentation approach (e.g., histograms, box plots, scatterplots, dot plots, tables, dashboards, bar charts, pie charts, line charts, bubble charts) for a given scenario

- Understand the benefits and limitations of visualization techniques

- Communicate results, conclusions, and recommendations in an impactful manner using effective visualization techniques

How to Pass CMA Part 1 Multiple-Choice Questions

It has been my experience that some people love the CMA exam multiple-choice questions (MCQ), while others get flustered and make silly mistakes.

If you are the latter, then you may want to follow these quick tips for crushing the MCQ section, and it all starts with understanding the structure.

MCQs are often devised of 3 parts; the question stem, the correct answer, and of course, distractor answers.

The question stem refers to the necessary details being asked of you to answer the question. This stem is often surrounded by irrelevant information, so make sure to identify the stem before considering your options.

Make sure to identify any negative statements, such as “except” or “false,” that may confuse you while answering

It goes without saying that the correct answer choice is the right choice, but sometimes it may not be so clear when your distractor questions may seem to be good choices also.

You will likely come across questions that propose a combination of correct answers, for example, “all of the above” or even something like “Answers 1, 3 and 4 is all correct.” In these scenarios go back to your stem question and underline and qualifiers that may help lead you to the right answer.

Please note that you must get at least 50% of the multiple-choice questions correct in order to move on to the essay section, so take your time and be thorough.

Understanding the Essay Section

As I mentioned earlier, the essay section is made up of two questions or scenarios. You will be expected to answer multiple questions that comprise this scenario, and you will likely have to perform calculations in addition to writing paragraphs.

The essay section is graded by experts and not done by computers, so it is best to write as much as you can on a topic to maximize your points.

The same goes when writing out calculations. You can receive partial points for a calculation even if you make a mathematical error, simply by showing your work. A few points are better than none.

CMA Part 1 Grading

Both parts of the CMA exam are structured similarly, and they are graded the same way as well.

Part 1 has 100 multiple-choice questions. This section will make up 75 percent of your final grade, and you need to score at least 50 percent to move on to the next section.

Something else worth noting about the multiple choice section of the CMA exam – while there are 100 questions, only 90 of them will be graded. The other 10 are used to create future versions of the exam.

The second section of the exam is the essay section. In this section, you’ll be given two essay scenarios and between four to six questions for each. This section is worth 25 percent of your overall grade.

Multiple Choice | Essay | |

CMA Exam Part 1 |

|

|

CMA Exam Part 2 |

|

|

If you feel overwhelmed, take a deep breath. More questions mean more opportunities to get questions right. You should always aim to get 500/500 — the highest grade possible — but you only need to achieve 360 to pass. With a little dedication and the right tools, you’ll have no problem accomplishing that.

CMA Part 1 vs. Part 2

There really is no definitive answer to which part of the CMA exam is harder. The answer depends heavily on what subject matter you’re more comfortable with.

Part 1 and part 2 of the CMA exam both have a 50 percent pass rate, which would signal an equal level of difficulty. But the recommended differences in study time may indicate that part one is slightly more challenging.

Both parts have identical structures and take the same amount of time to complete in the exam room.

To determine which part may be easier for you, take a look at your personal expertise. If you excel in all things accounting, part 1 might be easier for you. If you’re a whiz at finance, you might find part 2 easier.

At the end of the day, there’s no way of knowing how you’ll perform on each part of the exam. The only way to properly prepare is to study both parts equally.

Passing the CMA Exam Part 1

I know I’ve given you a lot to digest, but don’t feel overwhelmed. Part 1 of the CMA exam requires you to have a clear understanding of core concepts and be able to identify the subtle differences between them.

One of the best ways to gain confidence before taking the exam is to follow a study plan and take advantage of practice exams.

High-quality CMA review courses like my 16-Week Accelerator course give candidates the framework for studying for success.

By investing a reasonable amount of time in your studies and taking several practice exams to identify your strengths and weaknesses, you will be well on your way to passing CMA Part 1.

If you aren’t sure where to begin, hit me up in the comment section below. I am here to help you crush the exam on your very first try!

Hi, I’m Nathan Liao (aka the CMA Coach)! For the last 10 years, over 82,000 accounting and finance pros came knocking at my door seeking guidance and help. If you’re also aiming to conquer the CMA exam on your very first try—without wasting away time or money—you’ve found your ultimate guide. Dive in deeper to discover more about me and the dedicated team that powers CMA Exam Academy. Click here and let’s embark on this journey together!

41 Comments on “CMA Part 1 Demystified: Your Definitive Guide”

Hello,

My exam is on 22 of February

I have less than one month left For studying. can i pass the exam in this period of time .my educational background is MBA finance

Hi Nura,

The optimal study timeline I recommend is 4 months per part.

If you’d like private 1-on-1 coaching support to help figure out the next steps, I invite you to check out our CMA Tutoring program: https://cmaexamacademy.com/product/cma-exam-prep-live-virtual-1-on-1-tutoring/ You’ll be matched with a Certified CMA who will help answer all your questions via a private session on Zoom.

Nathan

Hey, how did your exam go? I am giving my exam on 28th feb. Any tips please?

Hi Tarun,

I invite you to check my article below:

The 4 Best Strategies to Prepare for Your CMA Exam Day

My problem at this time has been indecision due to my work schedule. I can’t seem to make up my mind because of the type of work schedule I have. I work an average of 10 -12 hours a day Monday through Friday. Saturday and Sunday I try to rest and attend to my family.

What kind of study plan can I adopt with such work schedule?

Hi Godfrey,

Thank you for your question.

Finding the time to study must be one of the biggest challenges for most CMA candidates. My program was built for people like you with busy schedules.

I’ve also put together a video that’ll help you create a study plan that works for you and your schedule. I’d recommend watching it to give you an idea on how to do it: CMA Study Plan for Working Professionals https://youtu.be/-uDc9s6x6gw

If you’re interested to learn more about how we can help you pass the exam by slashing your study time in half, please click the link below for all the details:

https://cmaexamacademy.com/product/premium-cma-coaching-combo-part-1-part-2/ref/nathan/

Nathan

Hi ,My name is Ahmed Abouzaid,I completed part 1 &2 in CMA and took certificate and I cannot find a JOB till now to utilize it

I need your help to apply in the ACADEMY

Hi Ahmed,

A few positions to apply could be Jr. Accountant, Staff Accountant, or even entry level A/R and A/P to gain some experience.

But by having the CMA, you won’t stay long in those positions as you’ll be able to move up faster.

As an IMA member, IMA’s Career Driver helps you explore your options and find management accounting roles according to your unique skillset.

If you have any questions left, please don’t hesitate to ask.

Nathan

Hi Nathan,

I am a non-accounting graduate and currently enrolled in my 2nd year of MBA program, I am interested in CMA after went through Managerial Accounting subject and wonder if your review course can help non-accountant like me to pass CMA.

I have a business and pretty much sure CMA can help me in the financial decision area.

Thank You

Hi Hakim,

Absolutely. Our program is designed for accountants at all levels and we’ve helped candidates with no prior accounting background pass the CMA exam on their first attempt.

We’ve also introduced a Fundamentals of Accounting textbook which helps students who are new to accounting quickly learn the core concepts before diving into the more complex CMA subject matter.

You can review all the study tools that are included with our coaching course at this link.

If you have any other questions, please don’t hesitate to reach out.

Thanks,

Nathan

I went for CMA Part 1 Exam in October and I was 10 points short. I booked the exam for May, but the situation is that I am not sure where exactly did I fell short on the exam.

I did feel good after the exam and didnt expect not to pass.

Any advise on my studying method, taking into account that I am in final year of university?

Hi Yara,

Prometric will email you a performance report within the next few weeks showing you the sections that need the most work.

You may also find helpful my YouTube video on the steps I recommend to succeed on your retake.

Thanks,

Nathan

Is there any scope of finished cma in India and job in abroad?

Since the US CMA is a global certification, it doesn’t matter where you take the exam – the value of the certification will be the same.

So yes, as a CMA, you’ll have the knowledge and skills to land a management accounting position abroad and excel at it.

Hi Nathan,

Could you help me in how to pass in CMA 2nd trial for Part-A, How Much time i have to spend to understand the concepts and how to apply on the exam day. What is the best way to pass in the Exam?!.

Thanks and regards

Sudhha

Hi Sudhha,

I have a YouTube video in which I go over the best study strategies to help you pass the exam. You can watch it here.

And here are more study strategies to help you score the most points on the MCQ and the essay section of the CMA exam.

I hope this helps, Sudhha. If you have any other questions, please don’t hesitate to hit reply.

Thank you,

Nathan

Thankyou Nathan!?

Hi Nathan,

Hope you are doing well.

I have to start CMA please guide me about study material and scheduled.

currently i am working as an accounts receivable.

Thanks.

Hi Noman,

I’m well, thank you. I hope you’re well too!

If you’d like to study with me, you can enroll in my complete course here.

Within this course, you’ll have access to all the study tools you need to successfully prepare for the exam, and I’ll guide you every step of your entire CMA journey so you never feel stuck 🙂

This course is designed to be completed in 16 weeks (one module per week) and it takes around 15 hrs/week to complete one module. Taking four months to study for each part of the exam will give you ample time to learn everything you need to know for the exam, and it’s long enough for you to consume all the material without forgetting key topics.

If you have any other questions Noman, please don’t hesitate to hit Reply.

Thank you,

Hi Nathan,

I planning to start CMA, What are the complete charges for part I & II and I’m salaried person, can I pay by monthly easy installment because one go payment cannot easy for me to pay.

And also need your step by step help or guidance to finish this course.

Thank you

Safdar

Hi Safdar,

Yes, you can opt for a payment plan when enrolling in our course. Click here to check the details.

As an Academy student, you’ll be guided by me and my team through every step of your CMA journey until you successfully pass the exam.

If you have any questions, just hit reply.

Thanks,

Nathan

Hi …..i completed my part 2 and now preparing for part 1 and also i am working ……. would you please help me to give a start on my studies which i really lack .. and suggest me on which to start with …. and which should i give more focus on as in exam point of view .

Thank you

Hi Elja,

I recommend studying every section from your textbook one by one and taking 50-MCQ practice exams of each section until you consistently score above 80% on them – that’ll be a good indicator that you’ve mastered that section and are ready to move on to the next one.

Then practice on exam simulations of the entire part until you score above 80% on them too – that’s when you’ll know you’re ready to pass the real exam.

Good luck!

Thank you so much !!! …Appreciate your response Nathan 🙂

My pleasure, Elja!

Hi Nathan,

I planning to start CMA by self study and i have a material, i need to know if can purchase just the test bank questions?

Thank you

Hi Ahmad,

Absolutely, you can order the test bank here.

Thank you,

Nathan

Appreciate your response Nathan

Thank you,

You’re very welcome! 🙂

where is your branch location in UAE, timing and fees?

Hi Eltayeb,

We provide an online CMA prep-course, meaning that we don’t have school locations. All of our training is done online to give our students the flexibility they need.

You can check here the pros and cons of online vs classroom learning to help you decide which study method will fit you best.

If you have any other questions, please don’t hesitate to hit reply 🙂

Hi Nathan

I want to know what all charges for the registration for Cma ,as my Registration is expired. And any changes in exam fee in the coming year, can you brief me all the charges connected with Cma part and part 2

Thanks

Tony Thomas

Hi Tony,

Here’s the list of fees you’ll need to pay to sit for the exam:

1. IMA Membership: $230/year, or $39/year if you’re a student – it’s an annual payment.

2. CMA entrance fee: $250 for professionals, or $188 for students.

3. Registration fee for one part of the CMA exam: $415/part, or $311/part for students.

Thanks,

Nathan

Hi Nathan,

This is Rashesh and if you could kindly give some inputs on the new Data Analytics subject as to what it covers in the Part 2 exam.

Thanks

Hi Rashesh,

Data Analytics is not covered in Part 2 syllabus. You can read the breakdown of all topics tested in Part 2 here.

Let me know if you have any other questions, Rashesh!

Has this course considered the changes in 2020 Exam Structure? Also, where did you get the example questions for the new modules (eg: Technology and Analytics?)

Hi Meity, yes our program has been updated for the 2020 exam. The IMA released sample questions for the new topics tested in 2020 which we are using our study material and also writing new questions based on those sample questions. Thanks, Nathan

What are the charges for part 1 preparation for intermediate.

Mridula, the Part 1 exam does not have an intermediate level. It’s just one exam.

Hi Nathan,

Could you please make me understand the difference between between Part 1 topic external financial reporting decision and Part 2 financial reporting analysis.

Thanks and regards,

Rashesh

Hi Rashesh,

Sure! Section A in Part 1 focuses primarily on the valuation of assets, liabilities and equity. Section A in Part 2 focuses primarily on company performance using financial ratios.