Unsure of what the requirements are to qualify for your Certified Management Accounting designation?

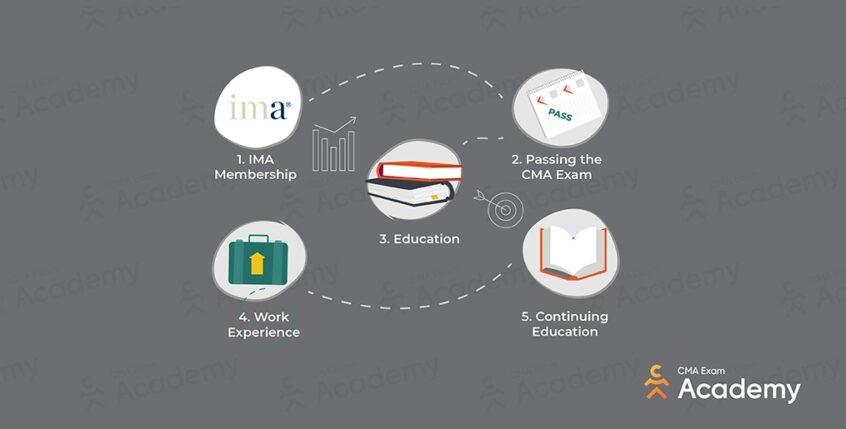

To become a CMA, you need to meet a set of requirements that demonstrate your knowledge, skills, and experience in management accounting.

First, there’s the certification requirement, which includes being a member of the Institute of Management Accountants (IMA), the professional body that governs the CMA designation. You’ll also need to pass both parts of the CMA exam, which test your understanding of core accounting, finance, and strategic management concepts.

The educational requirement ensures you have a strong academic foundation, while the experience requirement confirms that you can apply your knowledge effectively in real-world business environments.

Finally, to maintain your CMA designation, you must fulfill Continuing Professional Education (CPE) requirements each year. This ensures you continue to upskill and expand your knowledge throughout your career.

Below, I’ll break down each of these five CMA requirements in more detail so you know exactly what’s expected of you.

In short, the five Certified Management Accountant requirements you will need to fulfill include:

- IMA Membership Requirements for CMA

- Exam Requirements for CMA

- Educational Requirements for CMA

- Experience Requirements for CMA

- Continuing Professional Education (CPE) Requirements for CMA

Originally published on Nov. 26, 2019, this article was updated and republished on February 28th, 2026.

IMA Membership Requirements for CMA

The Institute of Management Accountants (IMA) serves as an association for finance and accounting professionals all around the world. It’s also the governing body behind the prestigious CMA designation. In order to take your CMA exam, you have to become an IMA member first.

Becoming an IMA member is fairly straightforward. You can do this by visiting the IMA website and paying the associated fees.

The IMA offers several different types of memberships: a regular membership and three discounted options. Let’s take a look at which one is best suited for you and the fees associated with each option.

IMA Professional Members

The IMA membership fee to become a professional member is $295 per year. This membership option is available to everyone who is not a student or an academic member (see the other membership options below).

What’s great about being an IMA member is that you get access to a wide range of benefits available worldwide. With a professional membership, you can take advantage of the IMA’s cutting-edge resources to help further expand and hone your knowledge and skills in all areas of management accounting. You can check out a full list of all the member resources available by visiting IMAnet.org.

IMA Student Members

If you are currently a student at an accredited college or university, then the IMA student membership is for you. It is perfect for individuals looking to kick-start their career in accounting or financial management.

Students have the option of choosing a one- or two-year membership. With a low fee of $49 per year (or $98 for the two-year option), student members around the world can access all of the IMA resources. Dive into the world of management accounting and discover potential career options while you’re earning your degree.

IMA Academic Members

The IMA academic membership is designed for full-time faculty members of accredited institutions. The membership fee for this option is $160 annually.

Members have access to benefits worldwide. In addition to this, academic members also have access to the IMA’s ethics curriculum, webinars, case studies, mentor programs, research grants, and various other teaching resources.

Staff Enrollment Discount Program

Looking to get a bit of a discount on your membership fee?

When your organization signs up five or more staff members, you become eligible for a 15% discount on IMA membership rates.

Similar to the other options, members have full access to all IMA amenities, including CMA certification, continuing education, networking, and more.

This discount is run under one company organizer name and paid as a lump sum each year. When adding new members to the program, fees are calculated on a pro-rata basis.

If a new employee has already paid their IMA membership for the year, no refund will be provided for unexpired months remaining in their current membership.

For full details on eligibility and pricing, click here. If you qualify, the IMA scholarship program can also help with costs.

Exam Requirements for CMA

This may be the most obvious requirement, but worth mentioning. To earn your CMA certification, you must take both Parts One and Two, and pass the CMA exam. Most candidates sit for one part per testing window, but passing only one part does not qualify you for certification. You must pass both parts to earn the CMA designation.

The key to succeeding with this requirement and passing the CMA on your first attempt is to give yourself plenty of time to study and prepare. This means choosing a CMA review course and following a study plan to ensure that you complete the entire course before your intended exam date.

Having taken the CMA exam and passed myself, I know that not all review courses are designed the same. Choosing one that offers one-on-one coaching, video tutorials, textbooks, test bank access, a 24/7 AI CMA coach, and a solid CMA study guide will help you study more efficiently and significantly increase your odds of passing the exam on your first attempt.

Not sure how to choose a course? Check out my comparison of the best CMA review courses.

Register for the Exam

In order to take the exam, you must first register for an exam time during one of the three CMA exam windows available each year:

- January/February

- May/June

- September/October

Exam registrations close on the 15th of the last month of each exam window. So for the January/February exam window, the registration closes on February 15th, for May/June, it closes on June 15th, and for the last exam window, September/October, exam registration closes on October 15th.

You may register on the IMA online store or by calling 800-638-4427 or (201) 573-9000.

After your registration is complete, you will receive your authorization from ICMA. From there, you can schedule your testing appointment at a Prometric Testing Center near you by logging onto www.prometric.com/ICMA.

How to Pass the CMA Exam

Each part of the CMA exam is four hours in total. You are given three hours to complete the multiple-choice section and one hour to complete the essay section. Note that the essay section will be officially replaced with case-based questions (CBQs) starting in Sep/Oct 2026.

Here’s what each part of the exam will cover:

Part One – Financial Planning, Performance, and Analytics

Duration: Four hours

Format: 100 multiple-choice questions and two 30-minute essay scenarios (to be replaced by two case-based questions)

How Is the CMA Exam Part One scored?

Key topics are marked differently depending on their category. Here is their breakdown:

- External Financial Reporting Decisions – 15%

- Planning, Budgeting, and Forecasting – 20%

- Performance Management – 20%

- Cost Management – 15%

- Internal Controls – 15%

- Technology and Analytics – 15%

Part Two – Strategic Financial Management

Duration: Four hours

Format: 100 multiple-choice questions and two 30-minute essay scenarios (to be replaced by two case-based questions)

How is the CMA Exam Part Two scored?

- Financial Statement Analysis – 20%

- Corporate Finance – 20%

- Decision Analysis – 25%

- Risk Management – 10%

- Investment Decision – 10%

- Professional Ethics – 15%

You must answer at least 50% of the multiple-choice questions correctly to move on to the written-response portion of the exam.

It is crucial to keep in mind that while you can move on to the next section with only 50% of the multiple-choice questions answered correctly, you would need to earn a minimum score of around 65% on the multiple-choice questions and a perfect score on the written-response section to actually pass the exam.

Once you have submitted your multiple-choice answers for scoring, you cannot go back.

If you do not answer 50% correctly, you automatically fail the exam part and will need to retake that part of the exam. There is no discount for an exam re-write, meaning you will pay the full CMA exam cost to retake that exam part.

Educational Requirements for CMA

There are two ways candidates can fulfill their CMA education requirements:

- Earn a bachelor’s degree from an accredited college or university

- Have a professional certification

Certified Management Accountant Requirements for a Bachelor’s Degree

Unlike other accounting certifications, the CMA does not require you to have a bachelor’s degree in finance or accounting, which does lower the barrier of entry. Your degree, however, must come from a regionally accredited or Distance Education Accrediting Commission (DEAC) accredited university or college.

A partial listing of accredited international and US institutions is available at http://univ.cc/world.php.

To verify your eligibility, candidates must have their university or college mail a copy of their transcripts directly to the ICMA.

If you did not attend an accredited school, you could have your transcripts evaluated by an independent agency, such as www.aice-eval.org or https://naces.org/.

IMA Professional Certification Requirements

In the event that you do not have a bachelor’s degree, you can still qualify for the CMA certification requirements by holding a professional certification.

The IMA provides a full list of approved professional certifications for your reference.

Verifying that your professional certification satisfies the education requirement is easy. Have the approving organization mail a confirmation letter to the ICMA stating that you are a qualified member.

What if You Don’t Meet the CMA Certification Requirements for Education?

If you have your heart set on becoming a CMA, but don’t feel like you meet the above criteria, there is another option: appeal to the IMA.

According to the CMA Handbook, the IMA does consider exemptions to the CMA certification requirements. In order to appeal for this process, you must write a detailed letter to the IMA explaining your situation.

Describe why you do not possess a degree or professional certification and how your experience and other credentials qualify you. Be sure to mention any other certifications you may have earned to build yourself a strong case. Email your request to [email protected] for confirmation.

Experience Requirements for CMA

As it turns out, understanding the CMA certification requirements for work experience can be confusing to many candidates.

Determining your work experience eligibility doesn’t have to be complicated. Here are a few simple steps to follow.

Determine if Your Work Experience Meets the CMA Certification Requirements

The CMA Candidate Handbook breaks down work experience relevance nicely by listing several job titles that would be applicable. It states:

“Qualifying experience consists of positions requiring judgments made employing the principles of management accounting and financial management.”

Such employment includes:

- Preparation of financial statements

- Financial planning and analysis

- Month-end close, also quarter and year-end close

- Auditing (external or internal)

- Budget preparation and reporting

- Manage general ledger and balance sheets

- Forecasting

- Company investment decision-making

- Costing analysis

- Risk evaluation

[Reference: CMA Handbook]

The handbook clearly states that jobs that only use the occasional application of management accounting will not satisfy this requirement.

For example, internships or traineeships and clerical positions do not use management accounting principles enough to be considered relevant work experience.

If you are relatively new to the CMA, then you may not feel like the handbook’s definition is clear enough. Simply put, your job tasks must involve any of the following: internal or external auditing or analysis, handling financial statements and understanding how they affect a company, and/or being responsible for analyzing and reporting on financial statements.

If your job description covers any of those tasks, then you should have no trouble fulfilling the CMA experience requirements.

Experience Must Include Information Analysis

As I further understood the above, I realized that analysis is a large part of the work experience requirement. Inputting financial data is not the same as being able to interpret it.

One of the skills that truly sets CMAs apart from their non-CMA counterparts is their unique ability to analyze and forecast. It’s these practical skills that allow CMAs to give businesses greater credibility and a higher earning potential.

That being said, if your work experience does not relate to finance and accounting, but instead is in a niche like marketing, sales, or human resources, then it will not qualify as a CMA certification requirement.

Must Be a Permanent Employee

Internships and traineeships are fantastic opportunities to dip your toes into the world of finance and accounting if you are unsure about your path.

Unfortunately, the IMA does not look at these types of employment in the same way as being a permanent employee.

In order to fulfill your CMA experience requirements, you must complete two consecutive years of full-time employment in an approved role OR four consecutive years of part-time, permanent employment (minimum 20 hours per week).

The route you choose is up to you. Just keep in mind that you must gain this work experience prior to taking the CMA or within seven years of passing the exam.

Here are some job titles to help guide you on your CMA career path.

- Chief Financial Officer (CFO)

- Corporate Controller

- Accounting Supervisor

- Accounting Manager

- Junior Accountant

- Staff Accountant

- Senior Accountant

- Financial Analyst

- Teacher or Entrepreneur

So, just how difficult is it to receive IMA approval?

In practice, it’s often more accessible than many candidates expect.

In the case of teachers, as long as 60% of your course load is related to finance or accounting above the principles level, you should have no problem in qualifying.

If you happen to be a business owner or entrepreneur, your chances are fairly good as well.

To apply for approval, create a proposal outlining your work experience and why you believe it is applicable. The IMA is happy to take these kinds of situations into consideration and will assess individuals on a case-by-case basis.

IMA’s definition of relevance is actually pretty broad, unlike other professional certifications. This could be in keeping in line with their barrier-to-entry approach. What I mean is that while you are required to have a Bachelor’s degree, the IMA does not stipulate that candidates have to have a Bachelor’s degree specifically in finance or accounting. It would seem they may have a more open approach to determining work relevancy as well.

Submit Proof You’ve Completed the CMA Requirements for Work Experience

Once you have completed your two years of full-time work experience (or four years of part-time work), it is time to submit proof and become one step closer to earning your certification.

Submitting CMA experience requirements is easy. To start, you must fill out the work verification form, which you can find on the IMA website here.

If you have any questions while filling out your form, you can call the IMA toll free at 1-800-638-4427 for assistance.

Continuing Professional Education (CPE) Requirements for CMA

The work does not stop once you have received your CMA certification. That’s right: CMAs are required to complete 30 hours of Continuing Professional Education (CPE) each year in order to maintain their certified status.

There is a broad range of subjects that qualify for CPE, but they must relate to topics covered by the ICMA’s examination.

For example, subjects may include accounting, financial management, economics, business applications of mathematics and statistics, and ethics.

Note: A minimum of two hours of ethics as part of your 30 hours of continuing education is required every year.

If you earn more than two hours of ethics CPE in one year, you may carry forward up to two hours to the following year.

Recording Your Continuing Education Credits

The reporting year for CPE begins January 1 of each new year. If you earn more than 30 hours at that time, you can carry forward up to 10 hours to the following year.

For example, if you took 45 hours of CPE courses this fiscal year, you can transfer 10 hours of that time to next year’s CPE requirements.

The best way to record your CPE credits is by organizing your transcripts under your IMA member profile. You can do this by logging into IMAnet.org, and under your “My Profile” section, choose “Transcript Information” on the left sidebar.

You can earn CPE by taking college or university courses, QAS self-study courses, attending professional meetings, speaking as a lecturer or teacher in a program, and many other options.

For a full list of options that fulfill the CMA CPE requirements, please visit IMAnet.org.

Still Have Questions About CMA Certification Requirements?

Here are the answers to some questions you may still have about Certified Management Accountant requirements.

Can I take the CMA Exam without experience?

You can begin to pursue becoming a Certified Management Accountant before you’ve completed your CMA education or experience requirements. Once you become a member of the IMA, you will be eligible to enter a CMA study program and take the CMA exam. In addition to passing both parts of the CMA Exam, you will have to complete a bachelor’s degree or show a comparable professional certification in order to get your CMA. You will also need to accomplish two years of continuous work in accounting. You can easily start the path toward becoming a CMA before you have much under your belt. Just know that you’ll have a few years of work to put in before you can get your CMA certificate.

What are the CMA requirements?

To meet all of the CMA requirements, CMAs must have completed a bachelor’s degree or a similar qualifying professional degree. They’ll also need two years of continuous professional experience in management accounting or financial management. On top of that, they will need an IMA membership and have passed a two-part exam.

Is a CMA certification worth it?

On average, accounting professionals who have a CMA certification earn 24% more in total compensation compared to their peers who don’t have a CMA. This is an advantage that is further amplified if you have both a CMA and a CPA. The CMA certification is worth it because of income potential alone. In addition to that, having a CMA opens a lot of doors in all kinds of companies. CMAs are considered leaders and are qualified to make important financial decisions for businesses.

How hard is the CMA Exam?

The CMA exam is a difficult test, evidenced by its 50% global average pass rate. Given in two parts, each of which covers a broad range of accounting topics, it is recommended that you study for at least 16 weeks per part if you hope to pass the CMA exam.

Which degree is best for CMA?

Most people who aim to get a CMA will pursue a bachelor’s degree in economics, business, accounting, or finance. You have to finish your bachelor’s degree from an accredited college or university before you can become a CMA. Meeting the CMA education requirements is just one of the steps you need to take to become a CMA.

Fulfilling all of your CMA certification requirements may seem like a daunting task, but it will be worth it in the end.

Take the Next Step

Understanding the CMA certification requirements is one thing. Passing the exam is another.

The CMA Exam Academy’s 16-Week Accelerator Program takes you from eligibility to exam-ready with a clear, structured plan. You’ll follow a step-by-step study roadmap for both Parts One and Two, receive weekly coaching and accountability, and get full access to lectures, practice questions, textbooks, and exam rehearsal support.

With unlimited coaching, a 92% average pass rate, and a Pass or 100% Refund Guarantee, our program helps you move beyond knowing what it takes and actually earn your CMA.

Have more questions regarding becoming a CMA? Pop them in the comment section below.

Hi, I’m Nathan Liao (aka the CMA Coach)! For the last 10 years, over 82,000 accounting and finance pros came knocking at my door seeking guidance and help. If you’re also aiming to conquer the CMA exam on your very first try—without wasting away time or money—you’ve found your ultimate guide. Dive in deeper to discover more about me and the dedicated team that powers CMA Exam Academy. Click here and let’s embark on this journey together!

30 Comments on “CMA Certification Requirements: Know What It Takes to Get Your CMA in 2026”

Hi

Other side Nandini. Needed the CMA cource for my son he is completeled his BBA graduation ( Aviation ) but he wanted to oursue CMA

I want to know. How this academy can help him. To join CMA

CONTACTS NO 9902090338

Hi Nandini,

Thank you for reaching out! We’d be happy to guide your son on his CMA journey. CMA Exam Academy offers a structured 16-week program with personal coaching, study plans, and all the materials needed to pass the CMA exam on the first attempt.

For all the details about our program I invite you to visit: https://cmaexamacademy.com/product/premium-cma-coaching-combo-part-1-part-2/

Hi,

I would like to clarify whether membership with IMA is mandatory upon passing both parts of the CMA exam (assuming I have already obtained the certificate), or if only the completion of 30 hours of CPE is mandated without the requirement of IMA membership.

Many thanks!

Hi Alph,

Completing 30 CPE credits per year is not enough to maintain your CMA designation.

Please note that you are required to have an active IMA membership to register for the exam. Additionally, the IMA membership must be renewed annually to maintain your CMA status after passing the exam.

Nathan

Hello, I am a staff accountant at an Accounting CPA firm. I do not have my CPA license. I worked previously as a grants accountant at a non-profit organization. Will I be able to qualify to take the CMA exam?

Hi Genise,

Thank you for your question.

To qualify for the CMA experience requirements, your role should include any of the following tasks like conducting internal or external audits, working with financial statements and interpreting their impact on the business, or being in charge of analyzing and reporting financial data.

If any of these responsibilities are part of your job, you’ll likely meet the experience criteria needed for the CMA certification.

Remember that you have the flexibility to fulfill your CMA experience requirement either before or after passing the CMA exam, within a seven-year timeframe.

For more information on the CMA requirements, I encourage you to check the CMA Handbook.

Does experience as a program financial analyst with monthly closing and some forecasting qualify as relevant experience?

Hi Patrick,

You can read more about the experience requirements in the CMA Handbook.

Nathan

Hi Nathan

Need further clarification on:

Do IMA & CMA provide applicants with the studying materials

Are there study/prep literature sold for professionals to buy, and how much?

Hi Jalal,

Thank you for your question.

The IMA doesn’t provide students with study material. Study material is sold by third party review course providers.

Our program includes digital textbooks and in paperback, test bank, formula guides, pre-recorded video, and audio lectures, coaching support, and weekly coaching calls with your CMA Coach inside our private group.

For all the details you’re welcome to click on the following link: https://cmaexamacademy.com/product/premium-cma-coaching-combo-part-1-part-2/

Hi Nathan,

I already passed both parts of the CMA exam but I have not submitted my Transcript of Records (TOR) yet due to the pandemic though I already requested for a copy from my University.

Is it ok to submit the TOR after the exam? If not, what are the consequences for late submission?

Thank you!

Hi Trisha,

According to the 2021 CMA Handbook “To become a certified CMA, candidates must satisfy (…) the education requirements and submit verification of education to ICMA within seven years of completing the CMA examination.

For further information, the best course of action is to contact the IMA directly. They will provide you with further clarification on what to do next.

Hi Nathan,

Can you please tell me the requirements to be a student member of ima? Is there any need of a consent letter from my college or is it should be affiliated to the local branch of ima?

Can you please tell me the steps for that?

Hopefully waiting for your reply…..

Regards. .

Hi Yugha,

To qualify for the student membership, a candidate must be enrolled in 6 or more credit hours at a college or university. If you are, then you’re eligible for the student discount.

Hi Nathan,

My degree is in a non-relevant subject (English Literature), However I have worked in some aspect in Finance for 12 years, Mainly as a Financial Analyst and more recently as Manager of Business Intelligence and Analytics. I would like to progress to become an FP&A Certified Professional, so believe completing the CMA first is my best way to progress.

My question here is that firstly, does my degree count as relevant for the education portion – and secondly does my experience in the field compensate for the lack of education when considering studying this?

Thanks for any help you can provide.

Hi James,

Yes, a degree in any field will meet the education requirement for the CMA certification.

Sounds like you’ve completed both the education and work experience requirement for the CMA. You’ll be able to submit them to the IMA for approval after enrolling in their CMA entrance program. You can get those requirements approved even before taking the exam, that way you’ll receive your CMA title and certification as soon as you pass your exam.

Let me know if you have any other questions!

Hi Nathan, thanks for such a detailed information. So helpful.

I got one question. Concerning the educational requirement for registration, can I submit my masters degree instead of barchelor degree?

Glad you found it helpful, Samuel.

The assumption is that if you have a Master’s degree, that you also have a Bachelor’s degree. If you’re looking to submit your Master’s only because it’s the most recent one, then sure, but be prepared to submit your bachelor’s as well if they ask for it.

Hello Nathan,

I’ve completed my Bachelors in Commerce and I am looking forward to study CMA, My doubt is if I work in my Father’s business will that experience be relevant if all financial decisions and planning will be done by me.

Regards

Hi Ameen,

As long as your job description covers the tasks described in the article, there should be no problem with getting your work experience approved by the IMA.

Thanks,

Nathan

Hi Nathan,

I am a student with no work experience. I’m currently preparing to take the CMA part 1 exam. In case I passed the 2 parts, how many years will I have to complete the 2 years of full-time work experience? Given that my IMA membership ends in 3 years, but I cannot start working now due to my college studies.

Hi Zahraa,

After passing both parts of the exam, you’ll have 7 years to fulfill the work experience requirement.

The IMA membership will need to be renewed annually after it expires.

Here’s what the IMA’s handbook states:

I am a student an pursuing cma certification. I presently have no work experience . So will i be able to get a job after completing my cma exam to fulfil my work requirement?

Yes, you’ll gain valuable knowledge and practical skills while studying for the CMA exam which will help increase your credibility when you apply for a job, and then help you advance quicker to higher positions.

Here’s a blog post on how to optimize your resume as a CMA candidate.

Let me know if you have any other questions, Karishma.

Thanks,

Nathan

Hi Nathan. I am a tax senior with several years experience in big 4 public accounting and industry. Do you think someone who worked primarily in tax would have the relevant work experience to qualify?

Hi Erica,

I think your work experience might qualify for the CMA certification, but it’s best to verify that directly with the IMA.

But if it doesn’t, that’s okay too because you’ll have 7 years after passing the CMA exam to fulfill it in order to obtain your CMA title and certification.

Thanks,

Nathan

Hi so i wanted to know whether or not my work experience will count. I am currently a full-time valuation associate at personal injury forensic accounting firm. It is essentially a litigation support accounting firm .

I deal with alot of quantifying economic loss of individuals, the future loss of income, CPP contribution calculation, Cost of Care

while it doesnt deal with companies alot it involves forecasting and quanityfing future income as well as costs of the person .

I would like to know if this would apply for the CMA work experience?

Hi Yash, it’s best to reach out directly to IMA to check if your experience qualifies for the CMA certification. You can email them at IMA/@/imanet.org

Hello,

I would like to know whether I may qualify to take the CMA exam in January 2025. Here are my credentials:

I have been a full- time employee with the state of California for 16 years. I began a position in Accounting as an officer with the State of California in January 2025. (I had been working in different state departments before this.) I am in a Training and Development program for the next two years. In addition to this, I will finish two years’ worth of college coursework in Accounting and Finance as part of the FSAP (Financial Services Accounting Program) that will award me a certification in January 2025. It’s a program that is created in joint partnership with the state of California and SEIU 1000. I have the option to earn an associate’s degree from the same community college in Work Experience, but I don’t wish to do that unless I need to do so.

I hold an MBA in Marketing (I also took Accounting and Finance as part of that MBA) and a BA in French.

I am receiving on-the-job experience at my job with the state of California. I will have two years’ experience by January 2025.

I am happy to obtain an IMA membership. May I join in January 2025 when I finish my Training and Development assignment? Do I need to join now?

I am happy to submit annual CPE credits. When do I need to start to do so?

Hi Samuel,

Thanks for reaching out. The IMA handles such requests, not us. Please contact the IMA directly through their website for further assistance.

Nathan